Rising Water Scarcity

The increasing prevalence of water scarcity is a critical driver for the Water and Wastewater Treatment Technologies Market. As populations grow and urbanization accelerates, the demand for clean water intensifies. According to recent estimates, nearly 2 billion people currently live in water-stressed areas, which is projected to rise. This scarcity compels governments and industries to invest in advanced treatment technologies to ensure sustainable water supply. Furthermore, the need for efficient wastewater management systems becomes paramount, as untreated wastewater poses significant health risks and environmental challenges. Consequently, the market for innovative treatment solutions is likely to expand, driven by the urgent need to address water scarcity and enhance water reuse practices.

Growing Public Awareness

Growing public awareness regarding water quality and environmental sustainability is increasingly influencing the Water and Wastewater Treatment Technologies Market. As communities become more informed about the implications of water pollution and the importance of clean water access, there is a rising demand for effective treatment solutions. Public pressure on governments and industries to adopt sustainable practices is leading to increased investments in water treatment technologies. Surveys indicate that a significant percentage of the population prioritizes environmental issues, which in turn drives policy changes and funding for innovative treatment projects. This heightened awareness is likely to sustain market growth as stakeholders seek to address public concerns.

Technological Advancements

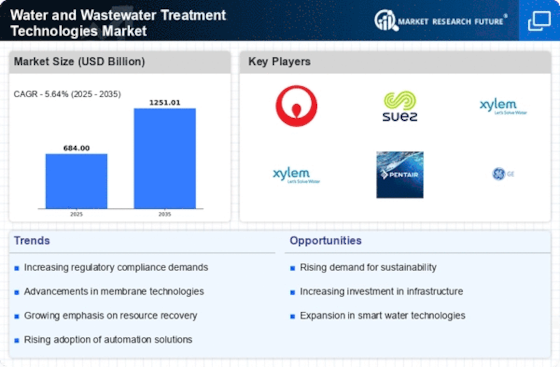

Technological advancements play a pivotal role in shaping the Water and Wastewater Treatment Technologies Market. Innovations such as membrane filtration, advanced oxidation processes, and biological treatment methods are revolutionizing the efficiency and effectiveness of water treatment. For instance, the adoption of membrane bioreactors has shown to enhance the quality of treated water while reducing operational costs. The market is expected to witness a compound annual growth rate of approximately 7% over the next few years, driven by these technological innovations. Moreover, the integration of automation and artificial intelligence in treatment processes is likely to optimize resource management and improve overall system performance, further propelling market growth.

Increasing Environmental Regulations

The imposition of stringent environmental regulations is a significant driver for the Water and Wastewater Treatment Technologies Market. Governments worldwide are enacting laws aimed at reducing pollution and protecting water resources. For example, the introduction of the Clean Water Act in various regions mandates the treatment of wastewater before discharge, thereby creating a robust demand for advanced treatment technologies. As industries strive to comply with these regulations, investments in innovative treatment solutions are expected to surge. This regulatory landscape not only fosters market growth but also encourages the development of sustainable practices within the industry, as companies seek to minimize their environmental footprint.

Investment in Infrastructure Development

Investment in infrastructure development is a crucial driver for the Water and Wastewater Treatment Technologies Market. Many regions are experiencing aging water infrastructure, necessitating upgrades and replacements to ensure reliable water supply and wastewater management. Governments and private entities are allocating substantial funds to modernize treatment facilities, which is expected to create a robust demand for advanced technologies. Reports suggest that infrastructure spending in the water sector could reach trillions of dollars over the next decade, highlighting the potential for market expansion. This investment not only addresses current challenges but also prepares systems for future demands, thereby fostering long-term growth in the treatment technologies market.