Water Purifier Size

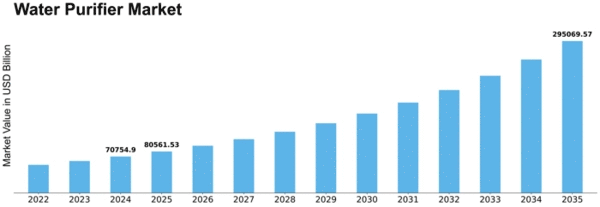

Water Purifier Market Growth Projections and Opportunities

In recent years, there has been a significant increase in the demand for commercial water filters worldwide. The market is being driven by advancements in technology within the commercial water filter sector. The introduction of smart filtration systems in commercial settings is expected to provide new opportunities for companies involved in the commercial water filter market. However, the potential hindrance to the market's growth comes in the form of high costs associated with equipment and maintenance.

The global demand for commercial water filters has been on the rise, reflecting an increasing awareness of the importance of clean and safe water. Technological advancements play a crucial role in enhancing the efficiency and effectiveness of commercial water filters, making them more appealing to a broader market. These advancements not only contribute to improved water filtration but also introduce innovative features that cater to the evolving needs of consumers and businesses.

One notable development in the commercial water filter market is the emergence of smart filtration systems. These intelligent systems are designed to bring automation and connectivity to commercial water filtration processes. The implementation of smart technology allows for real-time monitoring, data analysis, and remote control of water filter systems. This technological leap is anticipated to create a significant opportunity for companies operating in the commercial water filter market.

The introduction of smart filtration systems in the commercial sector is expected to revolutionize the way water filtration is managed. These systems can provide valuable insights into water quality, usage patterns, and maintenance needs, leading to more efficient and informed decision-making. With the ability to remotely monitor and control filtration systems, businesses can optimize performance, reduce downtime, and ensure a continuous supply of clean water.

Despite the promising prospects brought about by technological advancements, the growth of the global commercial water filter market faces challenges associated with high equipment and maintenance costs. The initial investment required for purchasing and installing commercial water filter systems can be substantial. Additionally, ongoing maintenance costs, including regular servicing and replacement of components, contribute to the overall expenditure.

The high costs associated with commercial water filters can pose a barrier to adoption, particularly for small and medium-sized businesses that may have budget constraints. The financial commitment required for acquiring and maintaining advanced filtration systems could limit the market penetration in certain segments. This challenge underscores the importance of addressing cost concerns to facilitate broader adoption of commercial water filters across diverse industries.

While the initial and maintenance costs are significant considerations, it's essential to weigh them against the long-term benefits and potential savings offered by efficient water filtration. Businesses that prioritize health, environmental sustainability, and operational efficiency may find the investment in advanced commercial water filters to be justified over time. The market players need to emphasize the long-term value and return on investment to encourage businesses to adopt these technologies.

The commercial water filter market is witnessing robust growth driven by increasing demand and technological advancements. The emergence of smart filtration systems presents a promising opportunity for market players to cater to the evolving needs of businesses. However, the challenges associated with high equipment and maintenance costs highlight the importance of addressing affordability concerns to ensure broader market access. As businesses and consumers recognize the long-term benefits of efficient water filtration, the commercial water filter market is poised for continued expansion. Efforts to enhance cost-effectiveness and communicate the value proposition will be crucial for sustaining growth and maximizing market potential.

Leave a Comment