Market Share

Water Desalination Pumps Market Share Analysis

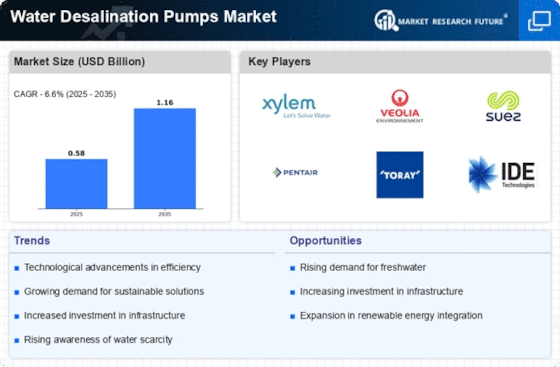

The water desalination pumps market has been experiencing significant trends in recent years, driven by the increasing global demand for fresh water in the face of growing population and water scarcity challenges. One prominent trend is the adoption of advanced technologies in desalination processes, leading to the development and utilization of more efficient and cost-effective pumps. With a surge in research and development activities, manufacturers are constantly innovating to enhance pump performance, reduce energy consumption, and optimize overall desalination plant efficiency.

Another notable trend in the water desalination pumps market is the rising focus on sustainable solutions. As environmental concerns become more prominent, there is a growing emphasis on developing desalination systems that minimize their ecological footprint. This trend has led to the integration of renewable energy sources, such as solar and wind power, into desalination plants. Pumps designed to operate seamlessly with these sustainable energy sources are gaining traction, aligning with global efforts to promote environmentally friendly practices in water treatment.

The market is also witnessing a shift towards modular and decentralized desalination systems. Traditional large-scale desalination plants are being complemented by smaller, more flexible units that can be deployed closer to the point of need. This decentralization trend allows for more efficient water distribution and reduces transmission losses. Pumps designed for modular desalination systems are characterized by their compact size, scalability, and adaptability, catering to diverse geographical and demographic requirements.

Furthermore, the integration of smart technologies and automation is playing a pivotal role in the evolution of the water desalination pumps market. Advanced monitoring and control systems are being incorporated to optimize pump performance, detect anomalies, and enhance overall operational efficiency. Real-time data analytics and remote monitoring capabilities are empowering plant operators to make informed decisions, reducing downtime and ensuring the longevity of pump systems.

In terms of geographical trends, regions facing acute water scarcity, such as the Middle East and parts of Asia, are witnessing a surge in desalination projects, driving the demand for water desalination pumps. Additionally, coastal areas around the world are increasingly turning to desalination as a reliable source of freshwater, contributing to the growth of the global desalination industry.

Despite these positive trends, challenges persist in the water desalination pumps market. High initial capital costs and energy consumption associated with desalination processes remain key concerns. However, ongoing research and development efforts are focused on addressing these challenges, with a goal to make desalination more economically viable and energy-efficient in the long run.

In conclusion, the water desalination pumps market is undergoing transformative changes driven by technological advancements, sustainability initiatives, decentralization trends, and the integration of smart technologies. As the world grapples with water scarcity challenges, the role of desalination in providing a sustainable and reliable source of freshwater is expected to grow, further fueling innovation and growth in the water desalination pumps market.

Leave a Comment