Rising Energy Demand

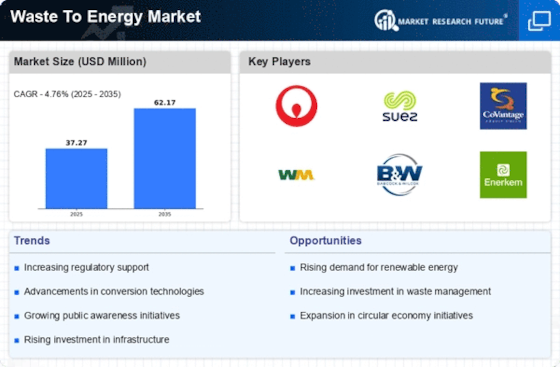

The increasing The Waste To Energy Industry. As populations grow and industrial activities expand, the need for sustainable energy sources intensifies. In 2023, energy consumption surged by approximately 5%, highlighting the urgency for alternative energy solutions. Waste to energy technologies offer a dual benefit: they not only generate energy but also mitigate waste disposal challenges. This duality positions the Waste To Energy Market as a viable solution to meet energy needs while addressing environmental concerns. The integration of waste management and energy production is likely to become more pronounced, as municipalities and industries seek to optimize resource utilization. Consequently, the Waste To Energy Market is poised for growth, driven by the necessity to fulfill rising energy demands sustainably.

Technological Innovations

Technological innovations play a significant role in shaping the Waste To Energy Market. Advances in conversion technologies, such as anaerobic digestion and gasification, have improved the efficiency and effectiveness of waste-to-energy processes. In recent years, the efficiency of energy recovery from waste has increased by approximately 15% due to these innovations. Enhanced technologies not only optimize energy output but also reduce emissions, making waste-to-energy solutions more environmentally friendly. As research and development continue to evolve, the Waste To Energy Market is likely to witness the emergence of new technologies that further enhance energy recovery rates. This continuous improvement in technology is essential for attracting investments and expanding the market, as stakeholders seek reliable and efficient waste-to-energy solutions.

Public-Private Partnerships

Public-private partnerships (PPPs) are emerging as a vital driver for the Waste To Energy Market. These collaborations between government entities and private companies facilitate the development and implementation of waste-to-energy projects. By leveraging the strengths of both sectors, PPPs can enhance project financing, risk management, and operational efficiency. In 2023, several successful waste-to-energy projects were launched through PPPs, demonstrating the effectiveness of this model. Such partnerships not only provide the necessary capital for large-scale projects but also foster innovation and knowledge sharing. As the Waste To Energy Market continues to evolve, the role of PPPs is likely to expand, enabling more comprehensive and effective waste management solutions that align with energy production goals.

Government Incentives and Policies

Government incentives and supportive policies are crucial in propelling the Waste To Energy Market forward. Many countries have implemented favorable regulations to encourage the adoption of waste-to-energy technologies. For instance, tax credits, grants, and subsidies are often provided to projects that convert waste into energy. In 2023, several nations reported a 20% increase in funding for renewable energy initiatives, including waste-to-energy projects. Such financial support not only reduces the initial investment burden but also enhances the economic feasibility of these projects. Furthermore, stringent waste management regulations compel municipalities to explore waste-to-energy solutions as a means of compliance. This regulatory landscape fosters a conducive environment for the Waste To Energy Market, potentially leading to increased investments and innovations in waste-to-energy technologies.

Environmental Concerns and Sustainability

Growing environmental concerns and the push for sustainability are driving the Waste To Energy Market. As awareness of climate change and pollution rises, there is an increasing demand for solutions that minimize environmental impact. Waste-to-energy technologies provide a means to reduce landfill waste while generating renewable energy. In 2023, it was estimated that waste-to-energy facilities could potentially divert over 30% of municipal solid waste from landfills, significantly reducing greenhouse gas emissions. This alignment with sustainability goals makes the Waste To Energy Market an attractive option for governments and businesses alike. The emphasis on circular economy principles further reinforces the relevance of waste-to-energy solutions, as they contribute to resource recovery and energy generation, thereby supporting a more sustainable future.