Rising Environmental Regulations

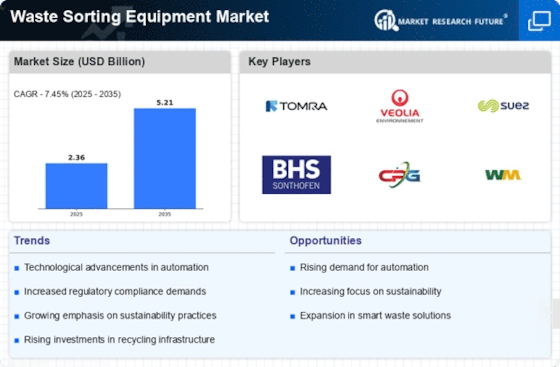

The Waste Sorting Equipment Market is significantly influenced by the rising environmental regulations imposed by governments worldwide. These regulations aim to reduce landfill waste and promote recycling initiatives, thereby creating a pressing need for efficient waste sorting solutions. For instance, many regions have implemented strict recycling targets, compelling municipalities to invest in advanced sorting technologies. The market is expected to witness a growth rate of around 8% as organizations strive to comply with these regulations. This regulatory landscape not only drives demand for waste sorting equipment but also encourages innovation within the industry, as manufacturers develop solutions that meet stringent environmental standards. Consequently, the Waste Sorting Equipment Market is poised for expansion as compliance becomes a priority for waste management entities.

Emergence of Circular Economy Initiatives

The emergence of circular economy initiatives is reshaping the Waste Sorting Equipment Market. These initiatives focus on minimizing waste and maximizing resource recovery, which necessitates advanced sorting technologies to separate recyclable materials effectively. As businesses and governments adopt circular economy principles, the demand for efficient waste sorting equipment is likely to increase. The market is projected to grow as organizations seek to implement systems that align with these sustainable practices. Furthermore, the transition towards a circular economy encourages innovation within the Waste Sorting Equipment Market, as manufacturers develop new solutions to meet the evolving needs of waste management. This shift not only enhances recycling rates but also contributes to a more sustainable future.

Growing Public Awareness of Waste Management

Public awareness regarding waste management and recycling practices is on the rise, significantly impacting the Waste Sorting Equipment Market. As communities become more educated about the environmental impacts of waste, there is an increasing demand for effective sorting solutions that facilitate recycling. Surveys indicate that over 70% of consumers are willing to support businesses that prioritize sustainable waste management practices. This shift in consumer behavior is prompting companies to invest in advanced waste sorting technologies to meet public expectations. The Waste Sorting Equipment Market is likely to benefit from this trend, as businesses seek to enhance their sustainability profiles and improve their waste management strategies. The growing emphasis on corporate social responsibility further fuels this demand, indicating a robust future for the industry.

Investment in Waste Management Infrastructure

Investment in waste management infrastructure is a critical driver for the Waste Sorting Equipment Market. Governments and private entities are increasingly allocating funds to enhance waste processing facilities, which includes upgrading sorting equipment. This trend is particularly evident in urban areas where waste generation is high, necessitating efficient sorting systems to manage the volume. Reports suggest that investments in waste management infrastructure could reach billions of dollars in the coming years, creating substantial opportunities for equipment manufacturers. As facilities expand and modernize, the demand for innovative waste sorting solutions is expected to grow, thereby propelling the Waste Sorting Equipment Market forward. This investment not only improves operational efficiency but also supports broader sustainability goals.

Technological Innovations in Waste Sorting Equipment

The Waste Sorting Equipment Market is experiencing a surge in technological innovations that enhance sorting efficiency and accuracy. Advanced technologies such as artificial intelligence and machine learning are being integrated into sorting systems, allowing for real-time data analysis and improved decision-making. This trend is reflected in the increasing adoption of automated sorting systems, which are projected to grow at a compound annual growth rate of approximately 10% over the next five years. These innovations not only streamline operations but also reduce labor costs, making waste sorting more economically viable. As municipalities and businesses seek to optimize their waste management processes, the demand for cutting-edge sorting equipment is likely to rise, further propelling the Waste Sorting Equipment Market.