Increasing Urbanization

The rapid pace of urbanization is a key driver for the Waste Management Equipment Market. As populations in urban areas continue to swell, the demand for efficient waste management solutions escalates. Urban centers are generating more waste than ever, with estimates suggesting that urban waste generation could reach 2.2 billion tons annually by 2025. This surge necessitates advanced waste management equipment to handle the increased volume and complexity of waste. Municipalities are investing in modern waste collection and processing technologies to ensure effective waste disposal and recycling. Consequently, the Waste Management Equipment Market is likely to experience substantial growth as cities seek to implement sustainable waste management practices that align with their urban development goals.

Technological Innovations

Technological advancements play a pivotal role in shaping the Waste Management Equipment Market. Innovations such as automated waste collection systems, smart bins, and advanced recycling technologies are transforming traditional waste management practices. The integration of Internet of Things (IoT) devices allows for real-time monitoring of waste levels, optimizing collection routes and schedules. Furthermore, the development of waste-to-energy technologies is gaining traction, potentially converting waste into renewable energy sources. These innovations not only enhance operational efficiency but also contribute to environmental sustainability. As municipalities and private companies adopt these technologies, the Waste Management Equipment Market is poised for significant expansion, driven by the need for smarter and more efficient waste management solutions.

Rising Environmental Awareness

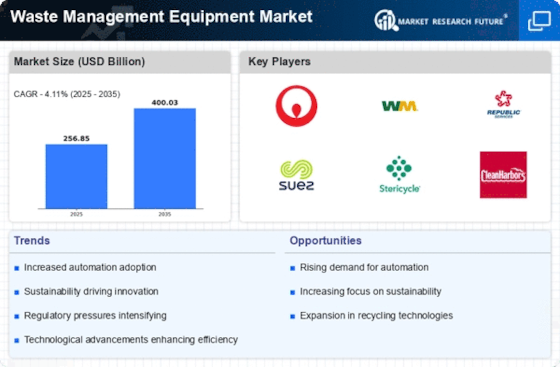

Growing environmental consciousness among consumers and businesses is a significant driver for the Waste Management Equipment Market. As awareness of the impacts of waste on the environment increases, there is a heightened demand for sustainable waste management practices. Companies are now prioritizing waste reduction, recycling, and responsible disposal methods. This shift in consumer behavior is prompting municipalities and waste management companies to invest in advanced equipment that supports these initiatives. The market for recycling equipment, in particular, is expected to grow, with projections indicating a compound annual growth rate of over 5% in the coming years. The Waste Management Equipment Market is thus likely to benefit from this trend as stakeholders seek to align their operations with environmentally friendly practices.

Economic Growth and Industrialization

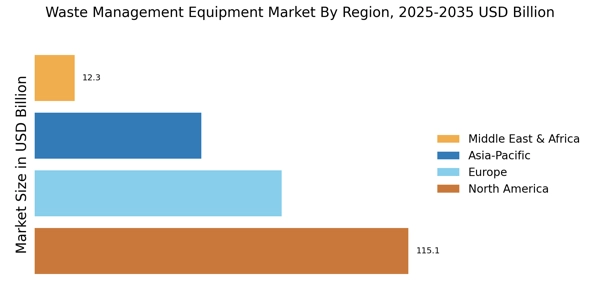

Economic growth and industrialization are significant factors influencing the Waste Management Equipment Market. As economies expand, industrial activities increase, leading to higher waste generation. This trend is particularly evident in developing regions, where rapid industrialization is creating a pressing need for effective waste management solutions. The construction, manufacturing, and retail sectors are among the largest contributors to waste, necessitating the deployment of advanced waste management equipment. Furthermore, as industries strive to enhance their sustainability profiles, there is a growing demand for equipment that facilitates recycling and waste reduction. Consequently, the Waste Management Equipment Market is expected to thrive as economic development drives the need for more sophisticated waste management solutions.

Government Initiatives and Regulations

Government policies and regulations are crucial drivers of the Waste Management Equipment Market. Many governments are implementing stricter waste management regulations to promote recycling and reduce landfill usage. These regulations often mandate the adoption of specific waste management technologies and practices, compelling municipalities and businesses to upgrade their equipment. For instance, some regions have set ambitious recycling targets, which necessitate the use of advanced sorting and processing equipment. Additionally, government incentives for adopting green technologies further stimulate market growth. As regulatory frameworks evolve, the Waste Management Equipment Market is likely to see increased investment in compliant technologies that meet these new standards.