Customer Experience and Personalization

Enhancing customer experience remains a pivotal focus within the Robotic Process Automation in Financial Services Market. Financial institutions are leveraging RPA to streamline customer interactions and provide personalized services. By automating routine inquiries and transactions, organizations can respond to customer needs more rapidly and accurately. This not only improves customer satisfaction but also fosters loyalty. The ability to analyze customer data through RPA enables firms to tailor their offerings, creating a more personalized experience. As competition intensifies, the emphasis on customer-centric strategies will likely drive further adoption of RPA solutions, making it an essential component of service delivery in financial services.

Data Management and Analytics Enhancement

The Robotic Process Automation in Financial Services Market is significantly influenced by the need for improved data management and analytics. Financial institutions generate vast amounts of data daily, necessitating efficient processing and analysis. RPA facilitates the automation of data entry, validation, and reporting, thereby enhancing data accuracy and availability. This capability allows organizations to derive actionable insights from their data more swiftly. As firms increasingly rely on data-driven decision-making, the demand for RPA solutions that support data management is likely to rise. The integration of RPA with advanced analytics tools further amplifies its value, positioning it as a key enabler in the financial services sector.

Regulatory Compliance and Risk Management

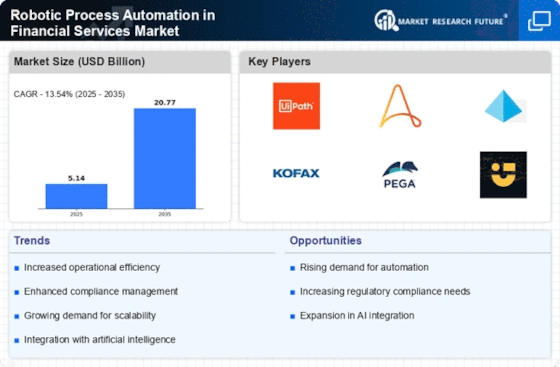

In the context of the Robotic Process Automation in Financial Services Market, regulatory compliance has emerged as a critical driver. Financial institutions face increasing scrutiny from regulatory bodies, necessitating robust compliance mechanisms. RPA offers a solution by automating compliance-related tasks, ensuring that organizations adhere to regulations efficiently. By implementing RPA, firms can reduce the risk of non-compliance, which can lead to substantial fines and reputational damage. The market for compliance automation is projected to grow, as institutions seek to mitigate risks associated with regulatory changes. This trend underscores the importance of RPA in enhancing compliance frameworks and managing operational risks.

Scalability and Flexibility of Operations

The scalability and flexibility offered by Robotic Process Automation in Financial Services Market is a compelling driver for adoption. Financial institutions are often required to adapt to changing market conditions and customer demands. RPA provides the agility needed to scale operations up or down without significant investments in infrastructure. This flexibility allows organizations to respond to fluctuations in workload efficiently. As firms seek to enhance their operational resilience, the ability to deploy RPA solutions rapidly becomes increasingly attractive. The trend towards scalable automation solutions is expected to continue, as financial services aim to maintain competitiveness in a dynamic environment.

Cost Efficiency and Operational Excellence

The Robotic Process Automation in Financial Services Market is witnessing a pronounced shift towards cost efficiency. Financial institutions are increasingly adopting RPA to streamline operations, reduce manual errors, and enhance productivity. By automating repetitive tasks, organizations can significantly lower operational costs. Reports indicate that RPA can reduce processing costs by up to 30%, allowing firms to allocate resources more effectively. This drive towards operational excellence not only improves the bottom line but also enables financial services to focus on strategic initiatives. As a result, the demand for RPA solutions is expected to surge, with many institutions recognizing the potential for long-term savings and improved service delivery.