Emergence of 5G Technology

The rollout of 5G technology is reshaping the landscape of the Wafer And Integrated Circuits Shipping And Handling Market. As telecommunications companies invest heavily in infrastructure, the demand for advanced integrated circuits is expected to escalate. This technology requires high-performance chips, which in turn drives the need for specialized shipping and handling solutions. The anticipated growth in 5G-related devices is projected to create a market worth over 1 trillion USD by 2030. Consequently, logistics providers must adapt to the unique requirements of shipping these sensitive components, ensuring they arrive in optimal condition.

Regulatory Compliance and Standards

The Wafer And Integrated Circuits Shipping And Handling Market is increasingly influenced by stringent regulatory requirements and industry standards. Compliance with these regulations is crucial for manufacturers and logistics providers alike. In 2025, the emphasis on quality assurance and safety protocols is expected to intensify, particularly in regions with strict environmental and safety regulations. This necessitates the implementation of robust shipping and handling practices that align with regulatory expectations. Companies that prioritize compliance are likely to gain a competitive edge, as they can assure clients of the integrity and safety of their products during transit.

Increasing Demand for Semiconductors

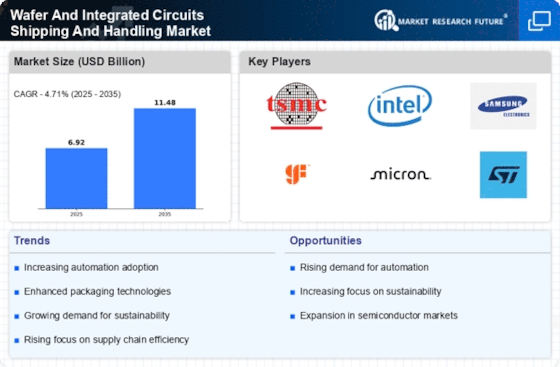

The demand for semiconductors continues to rise, driven by advancements in technology and the proliferation of electronic devices. This trend is particularly evident in sectors such as automotive, consumer electronics, and telecommunications. As the Wafer And Integrated Circuits Shipping And Handling Market adapts to this growing demand, it is essential to ensure efficient shipping and handling processes. In 2025, the semiconductor market is projected to reach a valuation of over 600 billion USD, indicating a robust growth trajectory. This surge necessitates enhanced logistics solutions to manage the increased volume of wafers and integrated circuits, thereby influencing shipping and handling practices.

Growth of E-commerce and Online Sales

The rise of e-commerce is transforming the Wafer And Integrated Circuits Shipping And Handling Market. As more companies shift towards online sales channels, the demand for efficient logistics solutions becomes paramount. In 2025, the e-commerce sector is expected to account for a substantial portion of the overall market, necessitating streamlined shipping and handling processes. This shift requires logistics providers to adapt to the unique challenges posed by e-commerce, such as rapid delivery times and the handling of high-value electronic components. Companies that can effectively navigate these challenges are likely to thrive in this evolving landscape.

Advancements in Packaging Technologies

Innovations in packaging technologies are playing a pivotal role in the Wafer And Integrated Circuits Shipping And Handling Market. Enhanced packaging solutions not only protect sensitive wafers and integrated circuits during transit but also contribute to sustainability efforts. In 2025, the market for advanced packaging materials is projected to grow significantly, driven by the need for improved protection and reduced environmental impact. These advancements enable logistics providers to offer more reliable shipping solutions, thereby enhancing customer satisfaction and trust. As packaging technologies evolve, they will likely redefine standards in the shipping and handling of electronic components.