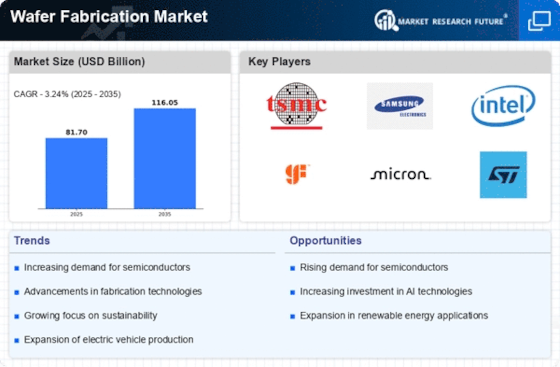

Increased Demand for Semiconductors

The Wafer Fabrication Market is witnessing an unprecedented increase in demand for semiconductors, driven by the proliferation of electronic devices and the rise of the Internet of Things. As of 2025, the semiconductor market is expected to reach a valuation of over 600 billion USD, with wafer fabrication being a critical component of this growth. The automotive sector, in particular, is experiencing a transformation with the integration of advanced driver-assistance systems and electric vehicles, further fueling the need for high-quality semiconductors. This escalating demand is likely to compel manufacturers to enhance their production capabilities and invest in advanced technologies, thereby propelling the Wafer Fabrication Market forward. The ongoing digital transformation across various sectors also contributes to this trend.

Investment in Research and Development

Investment in research and development is a driving force within the Wafer Fabrication Market. Companies are increasingly allocating resources to innovate and improve fabrication techniques, which is essential for maintaining competitiveness. As of 2025, it is estimated that R&D spending in the semiconductor sector will exceed 100 billion USD, reflecting the industry's commitment to advancing technology. This investment is likely to lead to breakthroughs in materials science, process engineering, and equipment design, which could significantly enhance production efficiency and product performance. Furthermore, collaboration between academia and industry is expected to foster innovation, creating a dynamic environment for the Wafer Fabrication Market. The focus on developing next-generation technologies is indicative of a forward-looking approach that could redefine the industry's landscape.

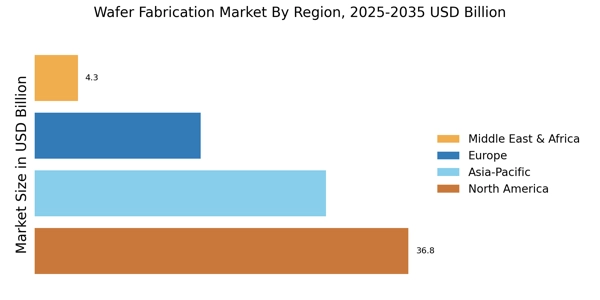

Emerging Markets and Regional Expansion

Emerging markets are playing a crucial role in the expansion of the Wafer Fabrication Market. Countries in Asia-Pacific, particularly China and India, are ramping up their semiconductor manufacturing capabilities to meet local and international demand. This regional expansion is supported by government initiatives aimed at boosting domestic production and reducing reliance on imports. As of 2025, it is projected that the Asia-Pacific region will account for over 50% of The Wafer Fabrication Market, significantly impacting the wafer fabrication landscape. The establishment of new fabrication plants and partnerships with technology firms is likely to enhance the competitive edge of these emerging markets. This trend indicates a shift in the Wafer Fabrication Market, as companies seek to capitalize on growth opportunities in these regions.

Sustainability Initiatives in Wafer Fabrication

Sustainability initiatives are becoming increasingly pivotal within the Wafer Fabrication Market. Manufacturers are adopting eco-friendly practices to minimize environmental impact, such as reducing water usage and energy consumption during production. The implementation of green technologies is not only beneficial for the environment but also aligns with regulatory requirements and consumer preferences. As of 2025, it is estimated that companies focusing on sustainable practices could see a market share increase of up to 15%. This shift towards sustainability is likely to attract investment and enhance brand reputation, thereby driving growth in the Wafer Fabrication Market. The emphasis on recycling materials and reducing carbon footprints further underscores the industry's commitment to sustainable development.

Technological Advancements in Wafer Fabrication

The Wafer Fabrication Market is currently experiencing a surge in technological advancements that enhance production efficiency and yield. Innovations such as extreme ultraviolet lithography and atomic layer deposition are revolutionizing the fabrication processes. These technologies enable the production of smaller, more powerful chips, which are essential for modern electronic devices. As of 2025, the market is projected to grow at a compound annual growth rate of approximately 7.5%, driven by these advancements. Furthermore, the integration of artificial intelligence in manufacturing processes is likely to optimize operations, reduce waste, and improve overall product quality. This trend indicates a robust future for the Wafer Fabrication Market, as companies invest heavily in R&D to stay competitive.