Top Industry Leaders in the Voice Over Wireless LAN Market

Competitive Landscape of Voice Over Wireless LAN Market:

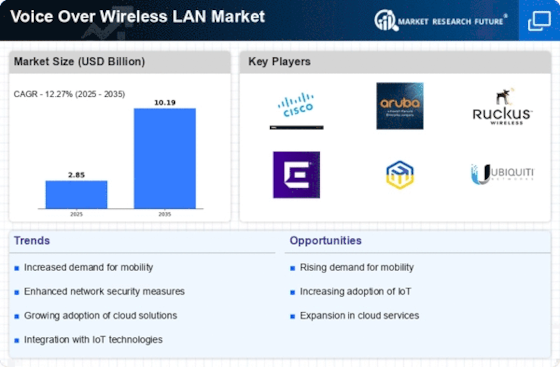

The Voice Over Wireless LAN (VoWLAN) market is a dynamic and rapidly evolving space, driven by the insatiable demand for seamless and efficient communication in today's mobile-centric world. Understanding the competitive landscape is crucial for any player seeking to navigate and capitalize on this lucrative market. This analysis will delve into the adopted strategies, key market share factors, emerging players, and the overall competitive scenario, offering a comprehensive overview for informed decision-making.

Key Players:

- Mitel Networks Corporation

- Cisco Systems, Inc

- KT Corporation

- Hewlett Packard Enterprise Company

- MetroPCS Communications Inc

- Viber Media, Inc

- MetroPCS Communications Inc

- InPhonex, Inc

- LG Uplus Corporation

- Infonetics Research Inc

- Verizon Wireless

- RingCentral, In

- Huawei Technologies Co. Ltd

- Aptilo Networks

- Ericsson

Strategies Adopted by Key Players:

- Technology Leadership: Established players like Cisco, Aruba Networks, and Avaya leverage their extensive R&D capabilities to stay at the forefront of innovation. By developing next-generation VoWLAN solutions with features like enhanced Wi-Fi 6 compatibility, improved voice quality, and advanced security protocols, they aim to maintain their market dominance.

- Vertical Specialization: Targeting specific industry segments with tailored VoWLAN solutions is a growing trend. Zebra Technologies caters to the needs of logistics and warehouse operations, while Aerohive Networks focuses on the education sector. This vertical focus allows for deeper understanding of customer requirements and development of solutions that address specific pain points.

- Cloud-based Offerings: Recognizing the shift towards cloud-based deployments, players like Alcatel-Lucent Enterprise are offering VoWLAN solutions as a service (VaaS). This subscription model reduces upfront costs for customers and simplifies management, making it an attractive proposition for businesses of all sizes.

- Strategic Partnerships: Collaborations with other technology providers and service integrators are becoming increasingly common. For example, Extreme Networks partnered with Microsoft to offer a unified communications solution that integrates VoWLAN with Microsoft Teams. These partnerships expand reach, enhance product offerings, and provide customers with comprehensive solutions.

Factors for Market Share Analysis:

- Brand Recognition and Reputation: Established players with strong brand recognition and a proven track record often hold an advantage in terms of market share. Their established customer base and reputation for reliability can be difficult for new entrants to overcome.

- Product Portfolio Breadth and Depth: Offering a comprehensive portfolio of VoWLAN solutions catering to diverse needs and budgets can attract a wider customer base. Players like Cisco, with their extensive range of access points, controllers, and software solutions, maintain a significant market share through this strategy.

- Global Presence and Channel Network: Having a strong global presence and a robust network of channel partners is essential for reaching a wider audience. Companies like Aruba Networks, with their extensive distribution network and presence across continents, can effectively penetrate new markets and expand their reach.

- Pricing and Cost-effectiveness: Offering competitive pricing and flexible deployment models can be a major differentiator. Smaller players, like Ruckus Wireless, often attract customers by offering cost-effective solutions that compete effectively with established brands.

- Customer Support and Services: Providing excellent customer support and comprehensive services can build loyalty and encourage repeat business. Players like Avaya, with their strong focus on customer service and post-sales support, retain customers and solidify their market position.

New and Emerging Companies:

Several new and emerging companies are disrupting the VoWLAN market with innovative solutions and disruptive business models. Some notable examples include:

- Mist Systems: Offering a cloud-based VoWLAN solution with AI-powered analytics and self-healing capabilities, Mist Systems is attracting customers seeking automation and simplified network management.

- Cambium Networks: With a focus on cost-effective and easy-to-deploy VoWLAN solutions for SMBs, Cambium Networks is carving a niche in the market with its user-friendly approach.

- CloudHedge: Providing VoWLAN as a fully managed service, CloudHedge eliminates the need for upfront investment and simplifies network management for businesses of all sizes.

Mitel Networks Corporation:

- October 27, 2023: Mitel announces interoperability with Aruba Wi-Fi 6 access points for improved Wi-Fi calling performance and network efficiency.

- September 12, 2023: Mitel releases MiVoice Business for Android 13 with enhanced Wi-Fi calling features, including seamless handoff between Wi-Fi and cellular networks.

- June 21, 2023: Mitel integrates its MiVoice Connect product with Google Meet, enabling businesses to use Google Meet for video conferencing directly from their MiVoice phones.

Cisco Systems, Inc:

- December 5, 2023: Cisco launches the Webex Go app for Android and iOS, offering VoIP calling and video conferencing on mobile devices.

- November 3, 2023: Cisco announces enhancements to its Wi-Fi 6E access points, including improved voice traffic handling capabilities.

- September 19, 2023: Cisco partners with Orange Business Services to deliver managed Wi-Fi 6 and VoWLAN solutions for enterprises.