Market Share

Vital Signs Monitoring Market Share Analysis

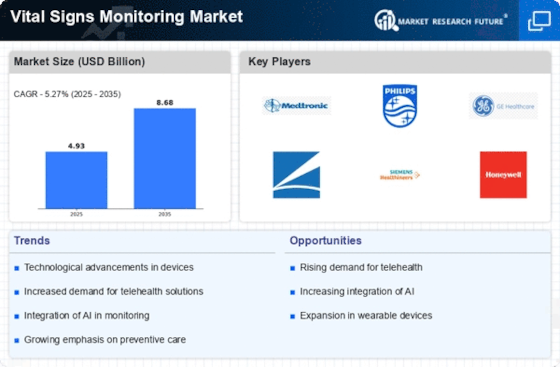

Within the ever-changing landscape that is characterizing the Vital Signs Monitoring Market, firms have implemented several strategies aimed at securing and improving their shares. Differentiation appears to be a major factor in companies' concentration on creating sophisticated vital signs monitoring instruments. Some of these may include wearable sensors for tracking patient's vitals or real-time remote monitoring systems as well. Cost leadership is critical within the Vital Signs Monitoring Market. This attempt is especially appealing to hospitals, clinics, and integrated health systems interested in obtaining quality devices with improved patient outcomes but, which also do not increase total medical costs too much. It will be crucial for companies offering cost-effective vital sign monitors if they want to capture a huge share in this particular market segment while enhancing access to advanced types of monitors. Companies targeting specific segments within the Vital Signs Monitoring Market point to niche market positioning. This can involve devising devices for critical care, neonatal care, and ambulatory monitoring, among others. Companies adopting their vital signs monitoring devices to adhere to regional regulatory standards and healthcare preferences consider geographic positioning. Knowing local healthcare ecosystems and customizing products to abide by local guidelines enables companies to penetrate different markets effectively. Some companies might be interested in areas where there is high demand for particular monitoring technologies or those that need more advanced vital signs monitoring solutions. The relationship of collaboration and partnerships in the Vital Signs Monitoring Market is pivotal as companies combine forces to enhance their capabilities as well as reach. These can comprise working together with health institutions, telemedicine service providers, and technology firms so that they can come up with fully integrated health systems that have a way of monitoring them remotely. Mergers and acquisitions are strategic moves that shape the competitive landscape of the Vital Signs Monitoring Market. Through these means, firms can access supplementary technologies, extend their intellectual property portfolio, or fortify their status as key players within the vital sign monitoring arena. Businesses need to be creative in order to survive, considering the continuous innovations found in the Vital Signs Monitoring Market, like investing in research and development for new features, better user experience, and improving the overall capability of monitor devices.

Leave a Comment