Top Industry Leaders in the Virtualized Evolved Packet Core Market

Competitive Landscape of Virtualized Evolved Packet Core Market

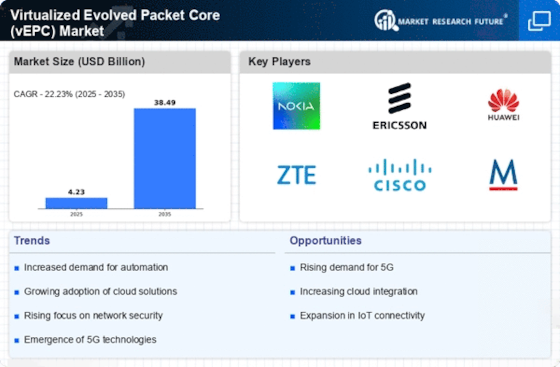

The virtualized evolved packet core (vEPC) market is experiencing a surge, driven by the widespread adoption of 5G and the need for flexible, scalable network infrastructure. This dynamic landscape presents both opportunities and challenges for established players and emerging challengers. Here's a comprehensive analysis of the vEPC market competition, including key players, their strategies, and factors influencing market share:

Key Players in the Arena:

- Nokia Corporation (Finland)

- Cisco System Inc. (US)

- Huawei Technologies Co. Ltd. (China)

- NEC Corporation (Japan)

- Ericsson AB (Sweden)

- SAMSUNG (South Korea)

- ZTE Corporation (Chine)

- Mitel Networks Corporation (US)

- Affirmed Networks (US)

- Athonet S.R.L. (Italy)

Strategies Driving Market Share:

- Technology Innovation: Players are constantly innovating, incorporating automation, artificial intelligence, and network slicing capabilities into their vEPC solutions to offer greater automation, efficiency, and network performance.

- Partner Ecosystem Development: Building strong partnerships with cloud providers, system integrators, and open-source communities is crucial for providing end-to-end solutions and expanding market reach.

- Flexible Deployment Models: Offering cloud-based, on-premises, and hybrid deployment options caters to diverse operator requirements and preferences for managing their vEPC infrastructure.

- Focus on 5G Standalone (SA): As 5G SA gains traction, players are tailoring their vEPC solutions to optimize network performance and enable advanced use cases like network slicing and edge computing.

Factors Influencing Market Share Analysis:

- Product Portfolio Breadth and Depth: Offering a comprehensive range of vEPC functionalities, including mobility management, policy control, and charging, is crucial for attracting larger operators with complex network needs.

- Price Competitiveness: Cloud-native vendors hold an edge in cost-effectiveness due to their open-source architecture and efficient resource utilization. However, established players counter with bundled solutions and competitive financing options.

- Global Reach and Market Presence: Strong regional presence and established relationships with local operators are critical for capturing market share in specific geographies.

- Customer Support and Services: Providing robust post-deployment support, maintenance, and network optimization services is essential for building long-term customer loyalty and repeat business.

New and Emerging Companies:

Several smaller players are entering the fray, focusing on niche areas like containerized vEPC deployments, network function virtualization (NFV) orchestration tools, and security solutions for vEPC infrastructure. These companies offer innovative approaches and cater to specific operator segments, potentially disrupting the market in the long run.

Current Investment Trends:

- Cloud-Native vEPC Solutions: Investors are actively backing cloud-native vEPC vendors due to their potential for disrupting the market with their agility and cost-effectiveness.

- Open-Source Adoption: Increasing interest in open-source vEPC platforms like OpenAirInterface (OAI) is attracting investment, as it promotes vendor neutrality and reduces dependency on proprietary solutions.

- 5G SA-Enabled vEPC: Players are investing heavily in developing vEPC solutions optimized for 5G SA, anticipating increased demand from operators as the technology matures.

Latest Company Updates:

NEC Corporation is set to launch its open virtualized RAN software package onto the global market in 2022. The vCU/vDU software suite from NEC makes use of the company's extensive technological leadership experience and dedication to enhancing Open Radio Access Networks (RAN). With best-of-breed products and services from NEC and its partners in the areas of open transport, automation, orchestration, converged packet core, software, open RAN radio units, and open transport, NEC Open Networks offers operators options in every category.

As per recent research by Dell'Oro Group, Huawei and Ericsson hold a strong position in the evolving packet core (EPC) industry in 2018. In the second quarter of this year, the total market share of the two vendors rose to almost 60%. Overall, the revenue from the EPC market.