Virtual Sensors Size

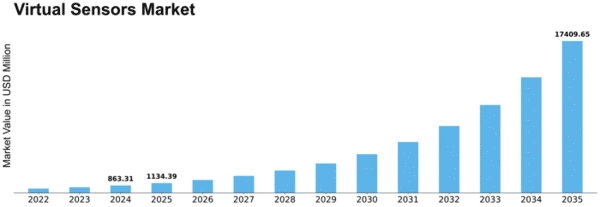

Virtual Sensors Market Growth Projections and Opportunities

The virtual sensors market proves to be a dynamic growth engine due to an increasing demand for a more affordable supplier of quality information and the use of data IoT techniques and virtualization technology. Market dynamics in most cases revolve around the capability of virtual sensors which imitate their physical counterparts to deliver valuable insights and predictive analysis that problems without having additional instruments will be easy to solve. The main reason for the increase in this market is that there is demand for systems of this kind for monitoring and control of processes of industry. In addition to the real sensors and devices, virtual sensors also involve mathematical models and algorithms that help in the way of simulating the physical objects, providing real-time data on aspects like temperature, pressure, and humidity. Firstly, this would lead to the replacement of physical sensors by other devices which in turn will enable them to enhance their decision-making processes and optimize operations.

A key factor resulted from the fact is the Internet of Things as a very important factor shaping the virtual sensors market dynamics. With the growth and spread of IoT-based use cases over different sectors, the need for low-cost and expandable solutions to collect and process data will become critical. Through IOs systems there is a crucial role which is played by virtual sensors so as to support physical sensors in complement and filling in dues collection. Virtual sensors through IoT can be used where physical sensors are not practical from the perspective of efficiency and also cost to bring about an increase in capabilities.

The competitive environment of the virtual sensors market is well-versed with traditional players and new entrants in the sector who offer wide-ranging solutions. Virtual sensors are patterning their use in industries including manufacturing, healthcare, and automotive as part of predictive maintenance, resource optimizing and operational efficiency to dimension their systems, respectively. Continuing the development of machine learning and artificial intelligence technologies takes the sensors even further by making them more adaptive and able to learn from their data patterns. This is to say that the more accurate and insightful predictions can be achieved.

Sustainability and energy efficiency is growing more powerful as well as tendencies in the market. Virtual sensors are used in the systems of energy management which provide businesses with the effective way to track and regulate the consumption to avoid the need to use plenty of physical sensors. This goes hand in hand with the global emphasis on sustainable practices and cost-effective resource utilization, as a result, fueling the adoption of virtual sensors in industries which are focusing on reducing the effects they have on environment.

Leave a Comment