Top Industry Leaders in the Virtual Network Functions Market

Competitive Landscape of the Virtual Network Functions Market

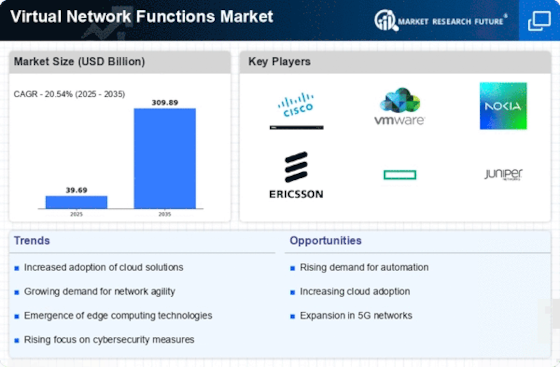

The Virtual Network Functions (VNF) market is surging, propelled by the relentless growth of internet traffic and network complexities. This lucrative domain, projected to reach a staggering USD 180.67 billion by 2031, has attracted a diverse array of players vying for dominance. Understanding the competitive landscape is crucial for navigating this dynamic market.

Key Players:

- Alcatel-Lucent (France)

- Cisco Corporation (US)

- Ericsson (Sweden)

- Huawei (China)

- Tech Mahindra (India)

- Ribbon Communications (US)

- Telefonica (Spain)

- Trend Micro (Japan)

- Verizon Communications (US)

- Fujitsu (Japan)

- HP Enterprise (US)

- NEC Corporation (Japan)

- F5 Networks (US)

- Aricent Incorporation (France)

Strategies Adopted:

- Product Diversification: Players are expanding their VNF portfolios beyond traditional offerings like firewalls and load balancers to encompass innovative solutions like network analytics, edge computing, and security gateways.

- Cloud-Native Focus: With the rise of cloud-based networks, players are developing VNFs specifically designed for deployment on cloud platforms, offering agility and scalability.

- Ecosystem Collaboration: Partnering with other players in the VNF ecosystem, including hardware vendors, cloud providers, and system integrators, is crucial for providing comprehensive solutions and reaching a wider market.

- Openness and Interoperability: Embracing open standards and APIs facilitates integration with existing networks and fosters collaborative innovation within the VNF ecosystem.

Factors for Market Share Analysis:

- Product Portfolio Breadth and Depth: Players with a diverse range of VNFs catering to various network functions and applications hold an advantage.

- Technological Innovation: Continuous investment in R&D to develop cutting-edge VNF solutions based on AI, machine learning, and automation is key to differentiation.

- Customer Base and Brand Reputation: Established players with strong relationships with service providers and a proven track record of successful deployments have a stronger foothold.

- Pricing and Commercial Models: Flexible pricing options and innovative commercial models like subscription-based services can attract cost-conscious customers.

- Geographical Reach and Local Expertise: Global presence and the ability to adapt solutions to regional regulations and network requirements are vital.

New and Emerging Companies:

- Ushering in Openness: Acumos, Pica8, and CloudHedge cater to the growing demand for open-source VNFs, offering greater flexibility and customization.

- Security Specialists: Netskope, Palo Alto Networks, and Fortinet are driving innovation in cloud-based network security VNFs.

- NFV Orchestration Leaders: Ansible, Juju, and Cloudify are developing advanced orchestration tools for simplifying VNF deployment and management.

Current Company Investment Trends:

- Cloud-Native VNF Development: Players are investing heavily in developing VNFs optimized for cloud deployment, recognizing the shift towards cloud-based networks.

- AI and Automation Integration: Embedding AI and automation capabilities into VNFs is a major focus, aiming to improve network efficiency and cost savings.

- 5G Network Readiness: Developing VNFs compatible with 5G networks is crucial, as the next generation of mobile technology expands.

- Security Solutions Prioritization: With cyber threats on the rise, investment in advanced security VNFs is a top priority for many players.

Latest Company Updates:

November 15, 2023: Ericsson partners with Google Cloud to deliver cloud-native VNFs for mobile networks, aiming for increased agility and cost efficiency.

December 05, 2023: VMware expands its VNF portfolio with acquisition of Uhana, a cloud-native security provider, strengthening its cloud security offerings.