Rising Investment in Biotechnology

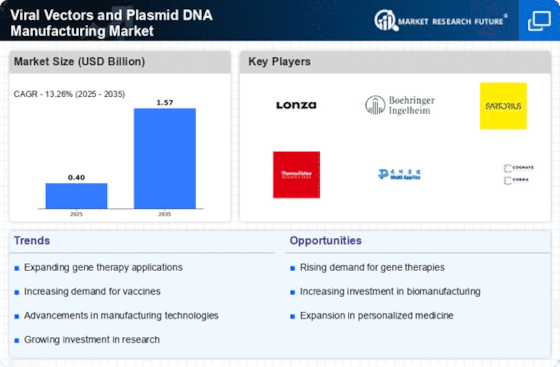

The surge in investment within the biotechnology sector is a crucial driver for the Viral Vectors and Plasmid DNA Manufacturing Market. Venture capital funding and government grants are increasingly directed towards companies specializing in gene therapy and related technologies. In recent years, the biotechnology sector has attracted billions in investments, reflecting a growing confidence in the potential of gene-based therapies. This influx of capital enables companies to enhance their research and development capabilities, thereby accelerating the production of viral vectors and plasmid DNA. As a result, the market is likely to experience robust growth, driven by the continuous innovation and expansion of therapeutic applications within the Viral Vectors and Plasmid DNA Manufacturing Market.

Growing Demand for Personalized Medicine

The increasing demand for personalized medicine is emerging as a vital driver for the Viral Vectors and Plasmid DNA Manufacturing Market. As healthcare shifts towards tailored treatment approaches, the need for specific gene therapies that cater to individual patient profiles is becoming more pronounced. This trend is supported by advancements in genomic technologies, which enable the identification of unique genetic markers associated with various diseases. The market is likely to expand as healthcare providers seek to implement personalized treatment plans, thereby increasing the utilization of viral vectors and plasmid DNA in therapeutic applications. This evolution in patient care signifies a transformative phase for the Viral Vectors and Plasmid DNA Manufacturing Market, aligning with the broader movement towards precision medicine.

Increasing Prevalence of Genetic Disorders

The rising incidence of genetic disorders is a pivotal driver for the Viral Vectors and Plasmid DNA Manufacturing Market. As more individuals are diagnosed with conditions such as cystic fibrosis, hemophilia, and muscular dystrophy, the demand for effective gene therapies is escalating. This trend is underscored by the fact that approximately 1 in 10 individuals are affected by a rare genetic disorder, which propels the need for innovative treatment solutions. Consequently, pharmaceutical companies are investing heavily in the development of viral vectors and plasmid DNA technologies to address these health challenges. The market is projected to witness substantial growth as healthcare providers seek advanced therapeutic options, thereby enhancing the overall landscape of the Viral Vectors and Plasmid DNA Manufacturing Market.

Regulatory Support for Gene Therapy Products

Regulatory bodies are increasingly providing support for the development and approval of gene therapy products, which is a significant driver for the Viral Vectors and Plasmid DNA Manufacturing Market. Initiatives aimed at streamlining the approval process for gene therapies are being implemented, thereby encouraging companies to invest in the development of viral vectors and plasmid DNA technologies. For instance, the introduction of expedited review pathways has facilitated faster access to the market for innovative therapies. This regulatory environment fosters a conducive atmosphere for research and development, potentially leading to a surge in the number of approved gene therapies. Consequently, the Viral Vectors and Plasmid DNA Manufacturing Market is poised for growth as more products gain regulatory approval.

Expanding Applications in Vaccine Development

The ongoing expansion of applications for viral vectors and plasmid DNA in vaccine development is significantly influencing the Viral Vectors and Plasmid DNA Manufacturing Market. With the increasing focus on preventive healthcare, the utilization of these technologies in creating vaccines for infectious diseases is becoming more prevalent. For instance, the use of viral vectors in the development of vaccines for diseases such as Zika and Ebola has demonstrated their potential. The market is expected to grow as more research institutions and biotech companies explore these applications, with the vaccine segment projected to account for a substantial share of the overall market. This trend indicates a promising future for the Viral Vectors and Plasmid DNA Manufacturing Market as it adapts to meet the evolving needs of public health.