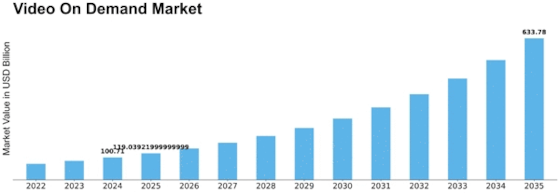

Video On Demand Size

Video on Demand Market Growth Projections and Opportunities

The Video on Demand (VOD) Market is influenced by a plethora of market factors that collectively contribute to its growth, trends, and overall dynamics. One of the primary drivers fueling the expansion of this market is the changing consumer behavior towards on-demand content consumption. As technology advances and internet connectivity becomes more pervasive, users increasingly prefer the convenience and flexibility of accessing video content at their own pace. The ubiquitous use of smartphones, smart TVs, and other connected devices further propels the demand for Video on Demand services, making it a dominant force in the entertainment industry. Technological innovation stands out as a pivotal factor shaping the Video on Demand Market. The continuous evolution of streaming technologies, video compression algorithms, and content delivery networks contributes to the seamless delivery of high-quality video content. The market responds to innovations such as 4K and HDR streaming, immersive audio experiences, and interactive features that enhance the overall user experience. Service providers that invest in cutting-edge technologies gain a competitive advantage, attracting users seeking the latest and best-in-class streaming experiences. Cost considerations play a significant role in the dynamics of the Video on Demand Market. While consumers value the convenience of on-demand content, they also weigh subscription costs against the perceived value of the available content library. Service providers that offer competitive pricing, flexible subscription plans, and a diverse range of high-quality content are better positioned to capture and retain a large user base. The affordability and accessibility of VOD services contribute to their widespread adoption across diverse demographic segments. Content is king in the Video on Demand Market. The availability of a diverse and compelling content library is a decisive factor in attracting and retaining subscribers. Original content production, exclusive licensing agreements, and a broad selection of genres cater to the varied preferences of audiences. Streaming platforms that invest in creating or securing exclusive content often find themselves in a favorable position, as compelling shows and movies become a significant differentiator in the competitive VOD landscape.

Leave a Comment