E-commerce Growth

The Vehicle Routing and Scheduling Market is witnessing substantial growth driven by the rapid expansion of e-commerce. As online shopping continues to gain traction, logistics and delivery services are under pressure to enhance their efficiency and responsiveness. The demand for timely deliveries has led to an increased reliance on sophisticated routing and scheduling systems that can accommodate fluctuating order volumes and customer expectations. Data suggests that the e-commerce sector is projected to grow at a compound annual growth rate of over 15% in the coming years. This growth necessitates advanced vehicle routing solutions to manage the complexities of last-mile delivery, thereby propelling the Vehicle Routing and Scheduling Market forward.

Rising Fuel Costs

The Vehicle Routing and Scheduling Market is significantly influenced by the rising costs of fuel, which have prompted companies to seek more efficient routing solutions. As fuel prices fluctuate, logistics providers are increasingly focused on minimizing fuel consumption through optimized routing. This trend is evident in the growing adoption of routing software that can calculate the most fuel-efficient paths. Reports indicate that companies utilizing advanced routing technologies can achieve fuel savings of approximately 15 to 25%. Consequently, the pressure to control fuel expenses is likely to propel the demand for innovative vehicle routing and scheduling solutions, thereby fostering growth in the market.

Increased Competition

The Vehicle Routing and Scheduling Market is characterized by heightened competition among logistics providers, which is driving the need for more efficient routing solutions. As companies strive to differentiate themselves in a crowded marketplace, the adoption of advanced scheduling technologies becomes essential. Enhanced routing capabilities can lead to improved service levels, reduced delivery times, and lower operational costs. Market analysis indicates that companies that invest in sophisticated vehicle routing systems can gain a competitive edge, potentially increasing their market share. This competitive pressure is likely to stimulate further innovation and investment in the Vehicle Routing and Scheduling Market, as businesses seek to optimize their operations.

Regulatory Compliance

The Vehicle Routing and Scheduling Market is also shaped by the need for regulatory compliance, particularly concerning emissions and safety standards. Governments worldwide are implementing stricter regulations aimed at reducing carbon footprints and enhancing road safety. As a result, logistics companies are compelled to adopt routing solutions that not only optimize delivery times but also ensure compliance with these regulations. The integration of compliance features into routing software is becoming increasingly common, allowing companies to avoid penalties and enhance their reputations. This regulatory landscape is likely to drive demand for advanced vehicle routing and scheduling technologies, as businesses seek to align their operations with legal requirements.

Technological Advancements

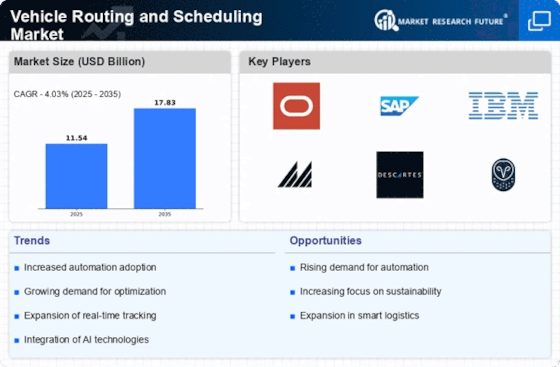

The Vehicle Routing and Scheduling Market is experiencing a surge in technological advancements, particularly in artificial intelligence and machine learning. These technologies enhance route optimization, allowing for more efficient scheduling and reduced operational costs. For instance, AI algorithms can analyze vast amounts of data in real-time, leading to improved decision-making processes. According to recent estimates, the integration of advanced technologies could potentially reduce fuel consumption by up to 20%, thereby increasing profitability for logistics companies. As businesses strive for operational efficiency, the demand for sophisticated routing and scheduling solutions continues to rise, driving growth in the Vehicle Routing and Scheduling Market.