Rising Geopolitical Tensions

The Vehicle Armor Materials Market is significantly influenced by rising geopolitical tensions across various regions. As nations prioritize national security, there is an observable increase in defense budgets, which directly impacts the demand for armored vehicles. Countries are investing heavily in modernizing their military fleets, leading to a heightened need for advanced armor materials that can withstand contemporary threats. For instance, defense spending in several countries has seen an increase of over 10% in recent years, reflecting a strategic shift towards enhancing military capabilities. This trend is expected to continue, thereby driving the Vehicle Armor Materials Market as governments seek to procure vehicles equipped with superior armor solutions to ensure the safety of personnel and assets.

Urban Warfare and Asymmetric Threats

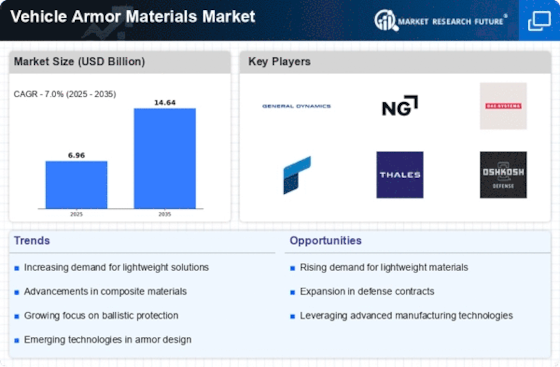

The dynamics of urban warfare and asymmetric threats are reshaping the Vehicle Armor Materials Market. As conflicts increasingly occur in urban environments, the demand for vehicles that can withstand close-quarter combat and improvised explosive devices is rising. This shift necessitates the development of specialized armor materials that provide enhanced protection without compromising mobility. The market is witnessing a growing interest in modular armor systems that can be adapted based on mission requirements. Analysts suggest that the need for such adaptable solutions could lead to a market growth rate of around 7% in the coming years. Consequently, the Vehicle Armor Materials Market is evolving to meet the unique challenges posed by urban combat scenarios, driving innovation and investment in advanced armor technologies.

Emerging Markets and Defense Modernization

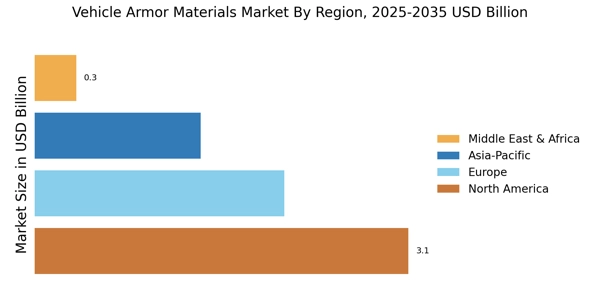

Emerging markets are becoming increasingly relevant in the Vehicle Armor Materials Market as countries modernize their defense capabilities. Nations in Asia, Africa, and South America are investing in upgrading their military fleets, which includes the acquisition of armored vehicles. This modernization is often driven by the need to address regional security challenges and enhance defense readiness. Reports indicate that defense spending in these regions is expected to grow by over 8% annually, creating substantial opportunities for armor material manufacturers. As these markets expand, the Vehicle Armor Materials Market is likely to benefit from increased orders for advanced armor solutions, fostering innovation and competition among suppliers to meet the diverse needs of emerging defense markets.

Technological Innovations in Armor Materials

The Vehicle Armor Materials Market is experiencing a surge in technological innovations that enhance the performance and effectiveness of armor materials. Advanced composites, such as aramid fibers and ultra-high molecular weight polyethylene, are increasingly utilized due to their lightweight and high-strength properties. These innovations not only improve the protective capabilities of vehicles but also contribute to fuel efficiency and maneuverability. The market for these advanced materials is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, indicating a robust demand for cutting-edge solutions in the Vehicle Armor Materials Market. Furthermore, the integration of smart materials that can adapt to different threats is likely to redefine the standards of vehicle protection, making it a pivotal driver in the market.

Increased Demand from Law Enforcement Agencies

The Vehicle Armor Materials Market is also experiencing increased demand from law enforcement agencies. As public safety concerns rise, police and security forces are seeking armored vehicles to protect personnel during high-risk operations. The trend towards urban policing and counter-terrorism efforts has led to a greater emphasis on equipping law enforcement with vehicles that can withstand ballistic threats. Recent data indicates that the procurement of armored vehicles by law enforcement has increased by approximately 15% over the last two years. This growing demand is likely to propel the Vehicle Armor Materials Market forward, as manufacturers respond by developing specialized armor solutions tailored to the needs of law enforcement agencies, thereby expanding their market reach.