Emergence of Predictive Analytics

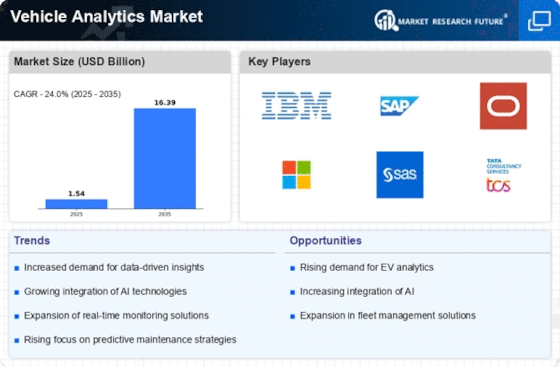

Predictive analytics is emerging as a transformative force within the Global Vehicle Analytics Market. By leveraging historical data and advanced algorithms, organizations can forecast future trends, maintenance needs, and potential failures. This proactive approach is particularly beneficial for fleet operators, as it allows for timely interventions and reduces downtime. The predictive analytics market is anticipated to grow significantly, with estimates suggesting a compound annual growth rate of around 12% over the next few years. As businesses increasingly recognize the value of predictive insights, the demand for analytics solutions that offer predictive capabilities is likely to rise, further shaping the landscape of the Automotive Analytics Market.

Advancements in Telematics Technology

Telematics technology is revolutionizing the Vehicle Analytics Sector by providing comprehensive data collection and analysis capabilities. The integration of GPS, onboard diagnostics, and cellular communication enables real-time monitoring of vehicle performance and driver behavior. This technological evolution is expected to propel the telematics market, which is anticipated to reach a valuation of over 100 billion dollars by 2026. The ability to gather and analyze vast amounts of data allows businesses to make informed decisions, enhance safety protocols, and improve overall operational efficiency. Furthermore, telematics solutions are increasingly being adopted by insurance companies to assess risk and tailor policies based on driving behavior, thereby influencing the dynamics of the Vehicle Data Analytics Market.

Increased Adoption of Connected Vehicles

The proliferation of connected vehicles is a key driver in the Vehicle Analytics Industry. As vehicles become more integrated with the Internet of Things (IoT), the volume of data generated is expanding exponentially. This connectivity allows for advanced analytics capabilities, enabling manufacturers and service providers to gain insights into vehicle performance, maintenance needs, and user preferences. The connected vehicle market is expected to witness substantial growth, with projections indicating a market size exceeding 200 billion dollars by 2025. This trend not only enhances the driving experience but also provides opportunities for businesses to develop innovative services and solutions, thereby propelling the Auto Analytics Industry forward.

Growing Emphasis on Safety and Compliance

Safety and compliance are paramount concerns within the Vehicle Analytics Sector, driving the adoption of analytics solutions. Regulatory bodies are imposing stricter safety standards, compelling organizations to invest in technologies that ensure compliance. The analytics derived from vehicle data can identify potential safety risks, monitor driver behavior, and facilitate adherence to regulations. As a result, companies are increasingly utilizing analytics to enhance safety measures and reduce liability. The market for safety analytics is projected to grow significantly, with estimates suggesting a rise of over 15% annually. This trend underscores the critical role of vehicle analytics in fostering a culture of safety and compliance within the transportation sector.

Rising Demand for Fleet Management Solutions

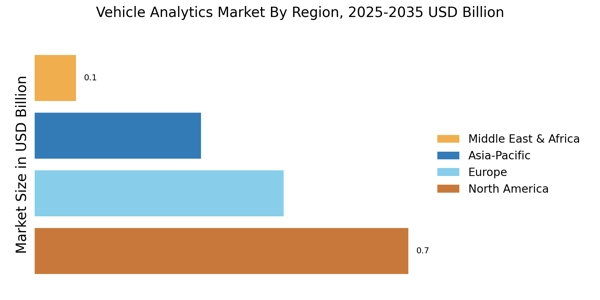

The Automotive Analytics Market is experiencing a notable surge in demand for fleet management solutions. Companies are increasingly recognizing the value of data-driven insights to optimize operations, reduce costs, and enhance efficiency. According to recent statistics, the fleet management sector is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is largely attributed to the need for real-time tracking, predictive maintenance, and improved route planning. As organizations strive to streamline their logistics and transportation processes, the integration of vehicle analytics becomes essential. Fleet managers are leveraging analytics to monitor vehicle performance, driver behavior, and fuel consumption, thereby driving the adoption of advanced analytics tools within the Vehicle Data Analytics Market.