Growth in the Bakery Sector

The Vanilla Market is significantly influenced by the expansion of the bakery sector, which has seen a resurgence in recent years. With the increasing popularity of artisanal and gourmet baked goods, the demand for high-quality vanilla has intensified. Data indicates that the bakery segment accounts for a substantial share of the vanilla market, with projections suggesting a growth rate of around 4% annually. This growth is fueled by consumer trends favoring indulgent and premium products, prompting bakers to seek out superior vanilla varieties to enhance flavor profiles. Consequently, the Vanilla Market is likely to thrive as it aligns with the evolving preferences of both consumers and bakers alike.

Rising Demand for Natural Flavors

The Vanilla Market is experiencing a notable increase in demand for natural flavors, driven by consumer preferences for clean label products. As health-conscious consumers seek alternatives to artificial additives, the appeal of natural vanilla has surged. According to recent data, the market for natural flavors is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This trend is particularly evident in the food and beverage sector, where vanilla is a favored ingredient in various applications, including desserts, beverages, and confectionery. The Vanilla Market is thus positioned to benefit from this shift, as manufacturers adapt their offerings to meet the growing consumer appetite for authenticity and quality.

Innovations in Vanilla Cultivation

The Vanilla Market is witnessing advancements in cultivation techniques that promise to enhance yield and quality. Innovations such as tissue culture propagation and improved pest management strategies are being adopted by farmers to address challenges associated with traditional vanilla farming. These methods not only increase production efficiency but also contribute to the sustainability of vanilla cultivation. As a result, the Vanilla Market may experience a more stable supply chain, which is crucial given the historical volatility in vanilla prices. Enhanced cultivation practices could lead to a more consistent availability of high-quality vanilla, thereby supporting the industry's growth and meeting the rising global demand.

Emerging Markets and Consumer Awareness

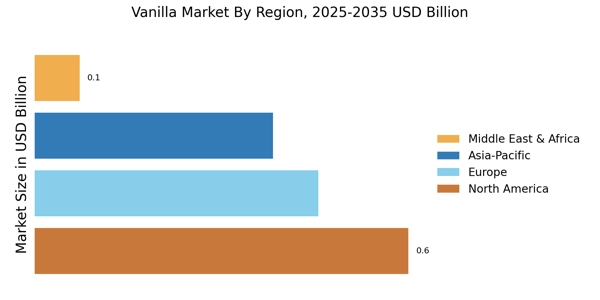

The Vanilla Market is poised for growth in emerging markets, where rising disposable incomes and increasing consumer awareness are driving demand for premium products. As consumers in these regions become more educated about the benefits of natural ingredients, the appeal of vanilla as a high-quality flavoring agent is likely to increase. Market data suggests that regions such as Asia-Pacific are experiencing a surge in vanilla consumption, particularly in the food and beverage sector. This trend indicates a shift in consumer behavior, with a growing preference for authentic flavors. The Vanilla Market may thus find new opportunities for expansion as it taps into these emerging markets and caters to the evolving tastes of consumers.

Increasing Use in Personal Care Products

The Vanilla Market is expanding beyond food applications, with a notable rise in the use of vanilla in personal care products. Consumers are increasingly drawn to the soothing and aromatic properties of vanilla, leading to its incorporation in fragrances, lotions, and skincare items. This trend is supported by data indicating that the personal care segment is projected to grow at a rate of approximately 3.5% annually. As brands seek to differentiate their products, the inclusion of natural vanilla is becoming a key selling point. The Vanilla Market stands to gain from this diversification, as manufacturers explore new avenues for vanilla utilization, thereby broadening the market's scope.