Increasing Demand for Energy

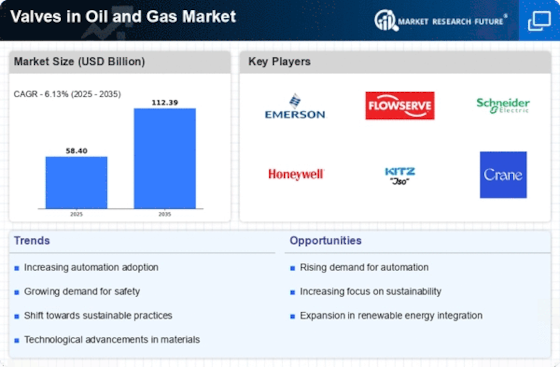

The rising The Valves in Oil and Gas Industry. As economies expand and populations grow, the need for reliable energy sources intensifies. This demand is particularly pronounced in developing regions, where energy infrastructure is being rapidly developed. According to recent estimates, the oil and gas sector is projected to witness a compound annual growth rate of approximately 3% over the next decade. Consequently, the need for efficient and durable valves becomes paramount, as they play a critical role in the extraction, transportation, and processing of hydrocarbons. The Valves in Oil and Gas Market must adapt to this increasing demand by innovating and enhancing product offerings to ensure operational efficiency and safety.

Focus on Environmental Sustainability

The increasing focus on environmental sustainability is reshaping the Valves in Oil and Gas Market. As stakeholders become more environmentally conscious, there is a growing demand for valves that minimize environmental impact. This includes the development of valves that reduce emissions and improve energy efficiency. Companies are now investing in research and development to create eco-friendly products that align with sustainability goals. Market trends indicate that the demand for such valves is likely to rise, driven by both regulatory pressures and consumer preferences. The Valves in Oil and Gas Market must adapt to this shift by prioritizing sustainable practices and products, which could lead to enhanced brand reputation and market share.

Investment in Infrastructure Development

Investment in infrastructure development is a crucial driver for the Valves in Oil and Gas Market. As countries seek to enhance their energy security and reduce dependence on imports, substantial investments are being made in oil and gas infrastructure. This includes the construction of pipelines, refineries, and processing plants, all of which require a wide array of valves. Recent reports suggest that infrastructure spending in the oil and gas sector could reach trillions of dollars over the next decade. Such investments not only create demand for valves but also stimulate job creation and economic growth. Consequently, the Valves in Oil and Gas Market stands to benefit significantly from these infrastructure initiatives, as they are integral to the successful operation of energy systems.

Regulatory Compliance and Safety Standards

Stringent regulatory frameworks and safety standards are pivotal in shaping the Valves in Oil and Gas Market. Governments and international bodies impose regulations to ensure environmental protection and worker safety, which necessitates the use of high-quality valves that meet these standards. For instance, the implementation of the ISO 9001 quality management system has become a benchmark for manufacturers. Compliance with such regulations not only enhances operational safety but also mitigates risks associated with leaks and failures. As a result, the demand for valves that comply with these regulations is likely to increase, driving growth in the Valves in Oil and Gas Market. Companies that prioritize compliance may gain a competitive edge in this evolving landscape.

Technological Advancements in Valve Design

Technological advancements are revolutionizing the Valves in Oil and Gas Market, leading to the development of more efficient and reliable products. Innovations such as smart valves equipped with IoT capabilities allow for real-time monitoring and predictive maintenance, thereby enhancing operational efficiency. The integration of advanced materials, such as corrosion-resistant alloys, further extends the lifespan of valves in harsh environments. Market data indicates that the adoption of these technologies could reduce maintenance costs by up to 30%, making them attractive to operators. As the industry continues to embrace these advancements, the Valves in Oil and Gas Market is expected to experience significant growth, driven by the demand for innovative solutions that improve performance and reduce downtime.