Vacuum Packaging Size

Market Size Snapshot

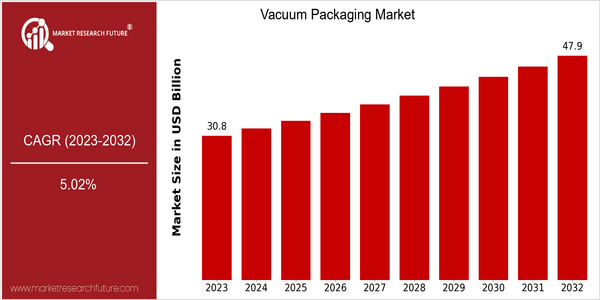

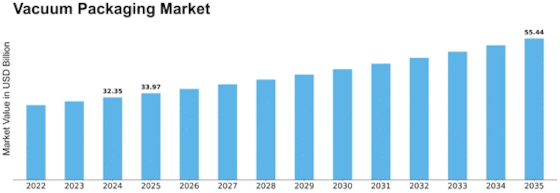

| Year | Value |

|---|---|

| 2023 | USD 30.8 Billion |

| 2032 | USD 47.89 Billion |

| CAGR (2024-2032) | 5.02 % |

Note – Market size depicts the revenue generated over the financial year

The vacuum-packaging market is expected to be worth about $ 30.9 billion in 2023 and $47.89 billion by 2032, with a CAGR of 5.02% from 2024 to 2032. This growth is due to the vacuum-packaging industry's strong demand for vacuum-packaging solutions in various industries, especially in the food and beverage industry, the pharmaceutical industry, and the consumer goods industry. The need for a longer shelf life, increased food safety, and reduced food waste have become the driving force for the development of vacuum-packaging technology. There are several factors that are driving this growth, such as the development of vacuum-packaging technology, the rising awareness of food safety, and the emergence of e-commerce, which requires the need for a variety of efficient packaging solutions. The leading vacuum-packaging companies, such as Sealed Air, Amcor, and Multivac, are constantly investing in new product development and strategic alliances to enhance their market share. For example, Sealed Air has developed a variety of sustainable packaging solutions in response to the growing demand for sustainable development. These strategic initiatives will help the market to continue to grow, and vacuum-packaging technology will remain a critical component in various industries.

Regional Market Size

Regional Deep Dive

The Vacuum Packaging Market is experiencing a significant growth across different regions, driven by increasing demand for food preservation, convenience, and safety. North America focuses on advanced technology and sustainable packaging. Europe focuses on compliance with regulations and innovation in packaging materials. The Asia-Pacific region is characterized by rapid industrialization and urbanization, which has led to a large demand for vacuum packaging solutions in the food and non-food sectors. The Middle East and Africa are gradually adopting vacuum packaging technology, mainly driven by the growing food industry. Latin America is also emerging as a major market, driven by growing consumer awareness of food preservation and waste reduction.

Europe

- The European Union's Green Deal is promoting sustainable packaging practices, encouraging manufacturers to invest in eco-friendly vacuum packaging technologies, which is reshaping the market landscape.

- Companies such as Multivac and Bosch Packaging Technology are at the forefront of developing advanced vacuum packaging machines that enhance efficiency and reduce waste, responding to the growing demand for sustainable solutions.

Asia Pacific

- Rapid urbanization in countries like China and India is driving the demand for vacuum packaging in the food sector, as consumers increasingly seek convenience and longer shelf life for perishable goods.

- The rise of e-commerce in the region has led to an increased need for vacuum packaging solutions that ensure product integrity during transportation, with companies like Amcor investing in innovative packaging technologies.

Latin America

- In Brazil, the government has launched initiatives to reduce food waste, which is driving the adoption of vacuum packaging solutions among food producers and retailers.

- Local companies are increasingly focusing on developing vacuum packaging solutions tailored to regional preferences, with a notable rise in demand for flexible packaging options.

North America

- The U.S. Food and Drug Administration (FDA) has implemented stricter regulations on food packaging, pushing companies to adopt vacuum packaging solutions to ensure food safety and extend shelf life.

- Innovations in biodegradable vacuum packaging materials are gaining traction, with companies like Sealed Air Corporation leading the way in developing sustainable packaging solutions that cater to environmentally conscious consumers.

Middle East And Africa

- The growing food processing industry in the UAE is leading to increased adoption of vacuum packaging technologies, with local companies like Al Ain Food & Beverages investing in modern packaging solutions.

- Regulatory changes aimed at improving food safety standards are prompting food manufacturers in the region to adopt vacuum packaging to comply with new guidelines.

Did You Know?

“Vacuum packaging can extend the shelf life of food products by up to five times compared to traditional packaging methods, significantly reducing food waste.” — Food and Agriculture Organization (FAO)

Segmental Market Size

The vacuum packaging sector is of great importance to the overall vacuum packaging market, which is growing steadily as a result of increasing demand for food safety and preservation. In particular, growing awareness of food waste and the convenience of food storage are driving this sector. Along with this, the demand for vacuum packaging is being driven by the need for food safety, which is in turn fuelled by regulatory policies. At present, vacuum packaging technology has reached a mature stage of development. Leading vacuum packaging companies, such as Sealed Air and Multivac, are constantly developing new solutions. In the food industry, vacuum packaging is mainly used for the preservation of meat, dairy and ready-made food, where it extends the shelf life of the product and maintains its quality. Along with this, companies are increasingly looking for sustainable packaging solutions. Also, new sealing and modified atmosphere packaging (MAP) technology is determining the evolution of this sector.

Future Outlook

From 2023 to 2032, the Vacuum Packaging Market is projected to grow at a CAGR of 5.02%. This growth is mainly driven by the growing demand for food preservation, increased shelf life, and product safety in various industries, such as food & beverage, pharmaceuticals, and consumer goods. As consumers become more health-conscious and environmentally aware, the demand for vacuum packaging solutions is expected to rise, with a penetration rate of over 30% in the food & beverage industry by 2032, compared to 20.6% in 2023. The development of more efficient vacuum packaging machines and sustainable packaging materials will also support the growth of the market. The introduction of smart packaging, which uses sensors to monitor the freshness and quality of products, will also play a key role in determining the consumer preferences and the market growth. The government’s initiatives to reduce food waste and encourage sustainable packaging practices will also create a favorable regulatory environment for the vacuum packaging industry. These trends will transform the vacuum packaging industry, presenting new opportunities for the players and enhancing the value chain.

Leave a Comment