Consumer Preferences

Shifting consumer preferences towards high-quality, durable automotive products are influencing the UV Stabilized Thermoplastic Elastomer For Automotive Market. Consumers are increasingly seeking vehicles that not only perform well but also maintain their aesthetic appeal over time. UV Stabilized Thermoplastic Elastomers offer superior resistance to fading and degradation, making them an attractive choice for manufacturers aiming to meet these consumer demands. Market Research Future indicates that products featuring these elastomers are perceived as more reliable and long-lasting, which could enhance brand loyalty and customer satisfaction. As a result, automotive companies are likely to invest more in these materials to align with consumer expectations.

Regulatory Compliance

The evolving landscape of regulatory compliance is driving the adoption of UV Stabilized Thermoplastic Elastomer For Automotive Market. Governments worldwide are implementing stricter regulations regarding material safety and environmental impact, prompting manufacturers to seek compliant materials. UV Stabilized Thermoplastic Elastomers are often favored due to their ability to meet these regulatory standards while providing excellent performance characteristics. This compliance not only helps manufacturers avoid penalties but also enhances their market reputation. As regulations continue to tighten, the demand for these elastomers is expected to rise, positioning them as a critical component in the automotive supply chain.

Electric Vehicle Growth

The rapid growth of the electric vehicle (EV) market is anticipated to significantly influence the UV Stabilized Thermoplastic Elastomer For Automotive Market. As automakers transition towards electric mobility, the demand for lightweight and durable materials is increasing. UV Stabilized Thermoplastic Elastomers are particularly suited for EV applications due to their excellent thermal and UV resistance, which is crucial for battery enclosures and exterior components. Market data indicates that the EV segment is expected to grow at a rate of over 20% annually, creating substantial opportunities for elastomer manufacturers. This trend suggests that the integration of these materials in EV production could become a key driver for market expansion.

Technological Innovations

Technological advancements in material science are likely to enhance the performance characteristics of UV Stabilized Thermoplastic Elastomer For Automotive Market. Innovations such as improved UV resistance, enhanced durability, and better processing techniques are being developed, which could lead to broader applications in automotive components. For instance, advancements in polymer blending and compounding techniques may result in elastomers that offer superior mechanical properties and thermal stability. This could potentially increase the adoption of these materials in high-performance automotive applications, such as exterior trims and seals. The market is expected to witness a surge in demand as manufacturers seek to leverage these innovations to improve vehicle performance and longevity.

Sustainability Initiatives

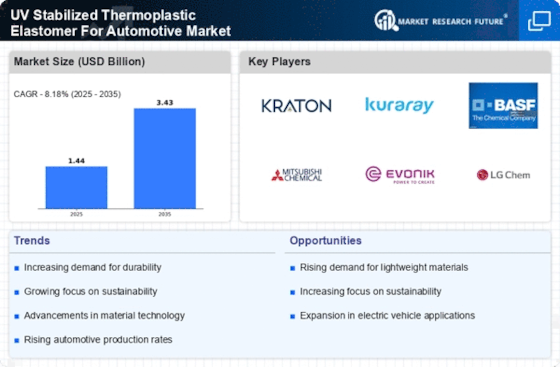

The increasing emphasis on sustainability within the automotive sector appears to drive the demand for UV Stabilized Thermoplastic Elastomer For Automotive Market. Manufacturers are increasingly adopting eco-friendly materials to meet regulatory requirements and consumer preferences. This shift is evidenced by the growing number of automotive companies committing to reduce their carbon footprints. The UV Stabilized Thermoplastic Elastomer is particularly appealing due to its recyclability and lower environmental impact compared to traditional materials. As a result, the market for these elastomers is projected to expand, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This trend indicates a significant opportunity for manufacturers to innovate and align their products with sustainability goals.