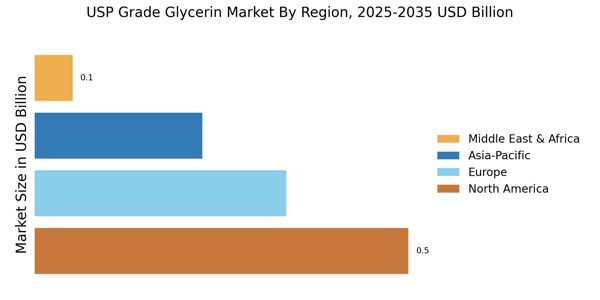

North America: Growth Consumption production

North America’s USP Grade Glycerin market is characterized by high regulatory compliance, robust industrial infrastructure, and diversified end-use demand. The U.S. leads the region, driven by strong consumption across pharmaceuticals, personal care, and processed food sectors. The presence of major personal care manufacturers (e.g., Procter & Gamble, Johnson & Johnson) ensures steady domestic demand. Stringent regulations enforced by the U.S. Food and Drug Administration (FDA) and United States Pharmacopeia (USP) ensure that only high-purity glycerin (≥99.7%) is used in ingestible and topical formulations. North America also serves as an innovation hub, with R&D investments targeting biocompatible ingredients, low-carbon oleochemicals, and organic-certified formulations. Vegetable-based glycerin is increasingly preferred due to consumer demand for clean-label, allergen-free, and sustainable products.

Europe: Emerging sustainable sourcing activities

Europe’s USP Grade Glycerin market is defined by regulatory stringency, sustainable sourcing practices, and a strong biodiesel-derived glycerin infrastructure. Countries such as Germany, France, the Netherlands, and the UK dominate demand due to their advanced pharmaceutical and cosmetic sectors. The EU’s REACH and ECHA regulations, alongside the British and European Pharmacopoeia (BP/Ph. Eur.) guidelines, dictate glycerin quality requirements, making Europe a benchmark region for safety and compliance. Europe benefits from its large biodiesel industry, which generates significant volumes of crude glycerol as a by-product. This supply is refined by regional players into USP-grade material.

Asia-Pacific: Rapidly Growing Glycerin Sector

APAC is the largest and fastest-growing region in the global USP Grade Glycerin market, with a dominant production and consumption base. Countries like China, India, Indonesia, Malaysia, and Thailand are both leading producers and consumers. The region benefits from abundant feedstock availability—particularly palm oil in Malaysia and Indonesia, and soy oil in China and India. A major portion of the world’s crude glycerol supply originates here, and a significant share is refined to USP standards for both domestic and export markets. Industrial growth, rising disposable incomes, and expanding urbanization are driving demand for glycerin in skincare, oral care, and pharmaceuticals.

Middle East and Africa: Emerging Glycerin Frontier

The MEA region holds the smallest share in the global USP Grade Glycerin market but is poised for growth. In the Middle East, particularly in Gulf Cooperation Council (GCC) countries, there is increasing demand for pharmaceutical-grade and cosmetic-grade ingredients due to the rise of wellness tourism, cosmetic surgery, and premium personal care brands. Africa’s demand is gradually rising, supported by population growth, urbanization, and expanding healthcare infrastructure. Most glycerin in MEA is imported from Asia and Europe due to limited regional manufacturing. As international players expand in Africa and the Middle East to tap into untapped markets, MEA could evolve into a strategic downstream consumption hub, especially with rising interest in halal, vegan, and eco-friendly formulations.

South America: Rapidly growth of USP grade

South America represents a growing yet underutilized market for USP Grade Glycerin, primarily led by Brazil and Argentina. Brazil, being one of the world’s largest soybean and biodiesel producers, generates vast quantities of crude glycerol. This makes it a key source of USP-grade refined glycerin for both regional and global markets. Domestic demand is supported by increasing penetration of personal care products and processed foods, while pharmaceutical and nutraceutical applications are also expanding due to government initiatives and better healthcare access. However, the market remains highly export-oriented, with a significant portion of refined glycerin shipped to North America and Europe. Challenges include infrastructure constraints, inadequate downstream refining capacity in some areas, and limited regulatory harmonization with global pharmacopeia standards.