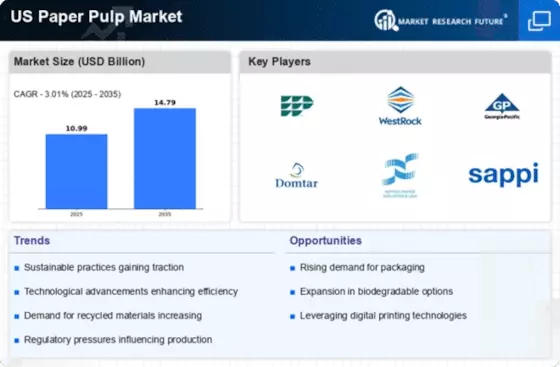

Growing E-commerce Sector

The rapid expansion of the e-commerce sector in the United States is a significant driver for the US Paper Pulp Market. As online shopping continues to grow, the demand for packaging materials, including paper pulp, is expected to increase. In 2025, the e-commerce market in the US was projected to reach over 1 trillion USD, leading to a corresponding rise in the need for sustainable packaging solutions. This trend is likely to encourage paper pulp manufacturers to innovate and develop new products that cater to the packaging needs of e-commerce businesses. The growth of this sector not only boosts demand for paper pulp but also fosters collaboration between manufacturers and retailers to create eco-friendly packaging options.

Technological Innovations

Technological innovations are transforming the US Paper Pulp Market by enhancing production efficiency and product quality. Advances in processing technologies, such as improved pulping methods and automation, have enabled manufacturers to produce high-quality paper pulp with reduced energy consumption. In 2025, it was estimated that companies adopting these technologies could reduce production costs by up to 20%. Furthermore, innovations in chemical treatments and recycling processes are allowing for the creation of new types of paper pulp that meet diverse consumer needs. As manufacturers continue to invest in research and development, the US Paper Pulp Market is likely to witness a surge in innovative products that cater to evolving market demands.

Sustainability Initiatives

The US Paper Pulp Market is increasingly influenced by sustainability initiatives aimed at reducing environmental impact. As consumers and businesses alike prioritize eco-friendly practices, the demand for sustainably sourced paper pulp is on the rise. In 2025, approximately 70% of US consumers expressed a preference for products made from recycled materials, which has prompted manufacturers to adapt their sourcing strategies. This shift not only aligns with consumer preferences but also complies with regulatory frameworks that encourage sustainable forestry practices. Consequently, companies that invest in sustainable production methods are likely to gain a competitive edge in the US Paper Pulp Market, as they can appeal to environmentally conscious consumers and meet stringent environmental regulations.

Rising Demand for Specialty Papers

The increasing demand for specialty papers is emerging as a key driver in the US Paper Pulp Market. Specialty papers, which include products such as coated papers, printing papers, and packaging materials, are witnessing a surge in popularity due to their unique properties and applications. In 2025, the specialty paper segment was projected to account for approximately 30% of the total paper market in the US. This trend is likely to encourage pulp manufacturers to diversify their product offerings and invest in specialized production techniques. As the market for specialty papers expands, the US Paper Pulp Market is expected to adapt, providing manufacturers with opportunities to cater to niche markets and enhance profitability.

Government Regulations and Policies

Government regulations and policies play a crucial role in shaping the US Paper Pulp Market. The US government has implemented various policies aimed at promoting sustainable forestry and reducing waste. For instance, the Forest Stewardship Council (FSC) certification has gained traction among manufacturers, ensuring that paper pulp is sourced from responsibly managed forests. Additionally, state-level initiatives encouraging recycling and waste reduction have further stimulated demand for recycled paper pulp. As these regulations become more stringent, companies that comply with them are likely to enhance their market position. The alignment with government policies not only fosters sustainability but also opens up new market opportunities within the US Paper Pulp Market.