Advancements in IoT Technology

The integration of Internet of Things (IoT) technology is significantly influencing the wireless sensor-network market. As IoT devices proliferate, the need for efficient communication and data collection becomes paramount. Wireless sensor networks facilitate seamless connectivity among IoT devices, enabling them to share data and insights effectively. This interconnectedness is particularly beneficial in sectors such as smart homes and industrial automation, where real-time monitoring and control are essential. The IoT market is expected to reach a valuation of over $1 trillion by 2026, which suggests a corresponding growth in the wireless sensor-network market as businesses adopt IoT solutions to enhance their operational capabilities.

Rising Demand for Real-Time Data

The market is experiencing a notable surge in demand for real-time data analytics across various sectors. Industries such as healthcare, manufacturing, and logistics are increasingly relying on instantaneous data to enhance operational efficiency and decision-making processes. For instance, the healthcare sector utilizes wireless sensor networks to monitor patient vitals in real-time, thereby improving patient outcomes. According to recent estimates, the market for real-time data analytics is projected to grow at a CAGR of approximately 25% over the next five years. This trend indicates a robust growth trajectory for the wireless sensor-network market, as organizations seek to leverage data-driven insights to optimize their operations.

Government Initiatives and Funding

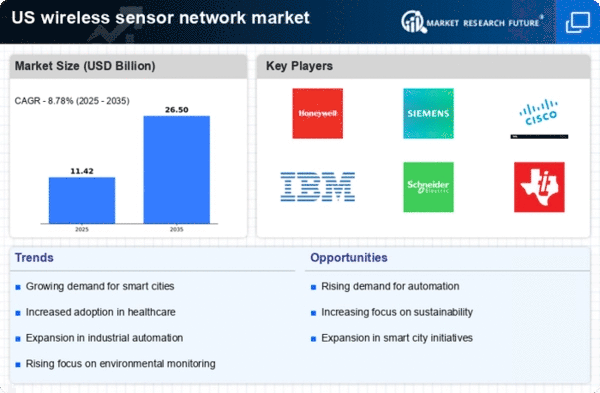

Government initiatives aimed at promoting smart infrastructure and technology adoption are playing a pivotal role in the growth of the wireless sensor-network market. Various federal and state programs are providing funding and support for the development of smart cities, which often rely on wireless sensor networks for efficient resource management. For instance, the Smart Cities Initiative encourages cities to adopt innovative technologies to improve urban living. This governmental backing not only stimulates investment in wireless sensor networks but also fosters collaboration between public and private sectors, thereby enhancing the overall market landscape.

Growing Need for Predictive Maintenance

The market is increasingly driven by the growing need for predictive maintenance across various industries. Organizations are recognizing the value of utilizing sensor networks to monitor equipment health and predict failures before they occur. This proactive approach minimizes downtime and reduces maintenance costs, leading to enhanced operational efficiency. Industries such as manufacturing and transportation are particularly benefiting from predictive maintenance strategies. The predictive maintenance market is anticipated to grow significantly, with estimates suggesting a CAGR of over 30% in the next few years. This trend underscores the potential for the wireless sensor-network market to thrive as businesses seek to implement advanced maintenance solutions.

Increased Focus on Environmental Monitoring

Environmental monitoring is becoming a critical driver for the wireless sensor-network market. With growing concerns about climate change and pollution, organizations are increasingly deploying wireless sensor networks to monitor air quality, water quality, and other environmental parameters. These networks provide valuable data that can inform policy decisions and promote sustainability initiatives. For example, cities are utilizing wireless sensor networks to track pollution levels and implement measures to improve air quality. The environmental monitoring market is projected to grow at a CAGR of around 20% in the coming years, indicating a strong potential for the wireless sensor-network market to expand in this domain.