Growing Demand for Convenience

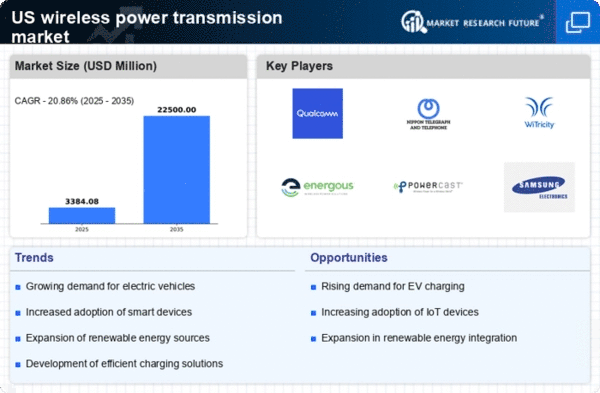

The wireless power-transmission market is experiencing a surge in demand driven by the increasing consumer preference for convenience in charging devices. As more electronic gadgets, such as smartphones, wearables, and electric vehicles, become integral to daily life, the need for hassle-free charging solutions intensifies. This trend is reflected in the market, which is projected to reach approximately $10 billion by 2026, growing at a CAGR of around 25%. Consumers are increasingly seeking solutions that eliminate the need for cables and connectors, thereby enhancing user experience. This shift towards convenience is likely to propel innovations in the wireless power-transmission market, as companies strive to meet the evolving expectations of tech-savvy consumers.

Rising Electric Vehicle Adoption

The rapid adoption of electric vehicles (EVs) is significantly influencing the wireless power-transmission market. As the automotive industry shifts towards electrification, the demand for efficient and convenient charging solutions is escalating. Wireless charging technology offers a promising alternative to traditional charging methods, allowing for more flexible and user-friendly experiences. The market for wireless EV charging is projected to grow substantially, with estimates suggesting it could reach $5 billion by 2027. This growth is driven by the need for infrastructure that supports the increasing number of EVs on the road, thereby positioning the wireless power-transmission market as a key player in the future of transportation.

Advancements in Energy Efficiency

Energy efficiency is becoming a pivotal driver in the wireless power-transmission market. As energy costs rise and environmental concerns grow, there is a pressing need for technologies that minimize energy loss during transmission. Recent advancements in resonant inductive coupling and microwave power transmission are enhancing the efficiency of wireless charging systems. For instance, systems are now achieving efficiencies of over 90%, which is a significant improvement compared to earlier technologies. This focus on energy efficiency not only reduces operational costs for consumers but also aligns with broader sustainability goals, making it a crucial factor in the growth of the wireless power-transmission market.

Integration with Smart Technologies

The integration of wireless power-transmission systems with smart technologies is reshaping the landscape of the market. As smart homes and IoT devices proliferate, the demand for seamless power solutions that can support multiple devices simultaneously is increasing. The wireless power-transmission market is likely to benefit from this trend, as it enables the charging of various devices without the clutter of wires. This integration is expected to enhance the functionality of smart devices, making them more appealing to consumers. Market analysts suggest that the adoption of wireless charging solutions in smart technology ecosystems could lead to a market valuation exceeding $15 billion by 2028.

Support from Government Initiatives

Government initiatives aimed at promoting clean energy and reducing carbon emissions are playing a crucial role in the wireless power-transmission market. Various federal and state programs are encouraging the development and adoption of innovative energy solutions, including wireless charging technologies. These initiatives often include funding for research and development, as well as incentives for companies that invest in sustainable technologies. The wireless power-transmission market stands to benefit from these supportive policies, which may lead to increased investment and accelerated growth. As the government continues to prioritize clean energy solutions, the market is likely to see enhanced opportunities for expansion and innovation.