Growth in Oil and Gas Sector

The vacuum truck market is positively impacted by the growth in the oil and gas sector, which requires specialized services for the transportation of hazardous materials and waste. As of 2025, the U.S. oil and gas industry is projected to grow by 5% annually, leading to increased demand for vacuum trucks capable of handling various types of waste generated during extraction and processing. This sector's expansion necessitates reliable and efficient waste management solutions, thereby driving investments in vacuum truck technology. Consequently, the vacuum truck market is likely to experience significant growth as operators cater to the specific needs of the oil and gas sector.

Increased Environmental Regulations

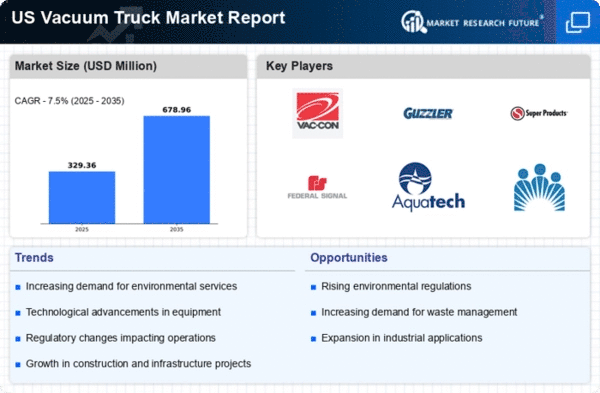

The vacuum truck market is influenced by heightened environmental regulations aimed at waste management and pollution control. In recent years, the U.S. Environmental Protection Agency (EPA) has implemented stricter guidelines for waste disposal, necessitating the use of advanced vacuum trucks that comply with these standards. As of 2025, the market is projected to grow by 8% annually, driven by the need for environmentally friendly waste management solutions. Companies are increasingly investing in vacuum trucks equipped with technologies that minimize emissions and enhance efficiency. This regulatory landscape compels operators to upgrade their fleets, thereby propelling the vacuum truck market forward.

Infrastructure Development Initiatives

The vacuum truck market is experiencing a boost due to ongoing infrastructure development initiatives across the United States. Government investments in public works, including road repairs and wastewater management systems, are driving demand for vacuum trucks. In 2025, the U.S. federal budget allocates approximately $1 trillion for infrastructure projects, which is expected to enhance the operational capacity of vacuum truck services. As municipalities and private contractors seek efficient solutions for debris removal and liquid waste management, the vacuum truck market stands to benefit significantly. This trend indicates a growing reliance on specialized vehicles capable of handling various waste types, thereby expanding the market's potential.

Rising Demand for Liquid Waste Management

The vacuum truck market is witnessing a surge in demand for liquid waste management services, particularly in urban areas. As cities expand and populations grow, the need for effective waste disposal solutions becomes more pressing. In 2025, the liquid waste management sector is expected to account for over 60% of the vacuum truck market's revenue. This trend is driven by the increasing volume of wastewater generated and the necessity for timely and efficient removal. Consequently, operators are investing in advanced vacuum trucks that can handle various liquid waste types, thereby enhancing the overall service offerings within the vacuum truck market.

Technological Integration in Fleet Management

The vacuum truck market is benefiting from the integration of advanced technologies in fleet management. Companies are increasingly adopting telematics and GPS tracking systems to optimize operations and improve service delivery. In 2025, it is estimated that around 40% of vacuum truck operators will utilize these technologies to enhance efficiency and reduce operational costs. This trend not only streamlines logistics but also provides real-time data for better decision-making. As a result, the vacuum truck market is likely to see improved productivity and customer satisfaction, as operators can respond more effectively to service requests.