Sustainability Initiatives

Sustainability is becoming a central theme in the US Urban Air Mobility Market, driven by increasing environmental awareness and regulatory pressures. The shift towards electric propulsion systems in eVTOL aircraft is a testament to this trend, as these systems promise to reduce greenhouse gas emissions significantly compared to traditional aviation. Furthermore, urban air mobility solutions are being positioned as a means to alleviate ground traffic congestion, thereby contributing to lower urban pollution levels. According to the US Department of Transportation, the adoption of sustainable aviation technologies could lead to a 50% reduction in emissions by 2030. This focus on sustainability not only aligns with national goals but also enhances the market's appeal to environmentally conscious consumers and investors.

Public Acceptance and Demand

Public acceptance is a critical driver for the US Urban Air Mobility Market, as consumer willingness to adopt new transportation modes influences market growth. Surveys indicate that a growing number of Americans are open to using aerial taxis, particularly in densely populated urban areas where traffic congestion is a persistent issue. The potential for reduced travel times and increased convenience appears to resonate with urban dwellers. Moreover, as companies conduct demonstration flights and pilot programs, public exposure to eVTOL technology is likely to enhance familiarity and trust. The success of these initiatives may lead to increased demand for urban air mobility services, further propelling the market forward. As public perception evolves, it could play a pivotal role in shaping the future landscape of urban transportation.

Regulatory Framework Development

The establishment of a comprehensive regulatory framework is crucial for the US Urban Air Mobility Market. The Federal Aviation Administration (FAA) is actively working on regulations that will govern the operation of eVTOL aircraft, ensuring safety and efficiency in urban airspace. Recent initiatives include the development of air traffic management systems tailored for urban environments, which are expected to facilitate the integration of aerial vehicles into existing transportation networks. The FAA's commitment to creating a conducive regulatory environment is likely to instill confidence among investors and operators, thereby accelerating market growth. As regulations evolve, they may also address public concerns regarding noise, safety, and airspace congestion, which are pivotal for the acceptance of urban air mobility solutions.

Urban Infrastructure Development

The growth of the US Urban Air Mobility Market is closely linked to the development of urban infrastructure that supports aerial transportation. Cities across the United States are beginning to invest in vertiports and charging stations for eVTOL aircraft, which are essential for the operational viability of urban air mobility solutions. For example, Los Angeles and Dallas have initiated projects to establish vertiport networks that facilitate seamless integration with existing transportation systems. This infrastructure development is expected to create a robust ecosystem for urban air mobility, enhancing accessibility and convenience for users. As urban planners recognize the potential of aerial transportation, further investments in infrastructure are likely, which could significantly boost the US Urban Air Mobility Market.

Technological Advancements in eVTOL Aircraft

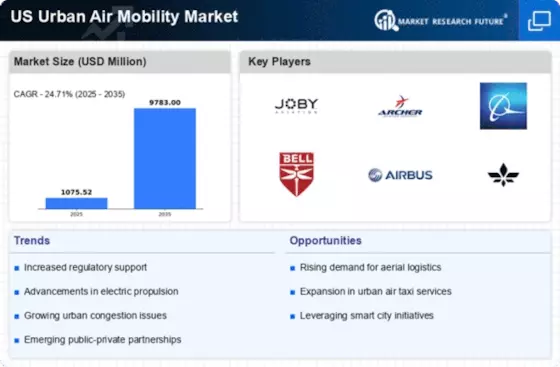

The US Urban Air Mobility Market is experiencing rapid technological advancements, particularly in electric vertical takeoff and landing (eVTOL) aircraft. These innovations are enhancing the performance, safety, and efficiency of urban air mobility solutions. For instance, companies like Joby Aviation and Archer Aviation are developing eVTOLs that promise to reduce travel times significantly in congested urban areas. The integration of advanced materials and autonomous flight systems is expected to lower operational costs and improve reliability. According to industry estimates, the eVTOL market could reach a valuation of over 1 trillion USD by 2040, indicating a robust growth trajectory. As these technologies mature, they are likely to attract substantial investments, further propelling the US Urban Air Mobility Market forward.