Emergence of 5G Technology

The emergence of 5G technology is poised to significantly impact the unified network-management market. With its promise of faster speeds and lower latency, 5G is expected to revolutionize how organizations manage their networks. This technology enables the deployment of advanced applications and services that require high bandwidth and real-time data processing. As businesses begin to adopt 5G, the demand for unified network management solutions that can effectively handle the increased data traffic and connectivity challenges will likely rise. Analysts predict that the 5G market will reach a valuation of $700 billion by 2026, indicating a substantial opportunity for unified network management providers to cater to the evolving needs of businesses in a 5G-enabled environment.

Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices is a key driver in the unified network-management market. As organizations adopt IoT technologies, the complexity of managing these interconnected devices increases. Unified network management solutions provide a centralized approach to monitor and control IoT devices, ensuring optimal performance and security. In the US, it is estimated that the number of connected IoT devices will reach 30 billion by 2025, creating a pressing need for effective management solutions. This trend indicates a growing reliance on unified network management systems to handle the influx of data and connectivity demands, thereby fostering market growth. The ability to integrate and manage diverse IoT devices seamlessly is likely to become a critical factor for businesses aiming to leverage IoT capabilities.

Shift Towards Remote Work Solutions

The shift towards remote work is reshaping the landscape of the unified network-management market. As organizations adapt to flexible work arrangements, the need for reliable and secure network management solutions becomes paramount. Unified network management systems facilitate seamless connectivity for remote employees, ensuring that they have access to necessary resources without compromising security. This trend is reflected in the increasing investment in network management technologies, with companies allocating approximately 20% of their IT budgets to enhance remote work capabilities. The market is poised for growth as businesses recognize the importance of maintaining productivity and collaboration in a remote work environment, driving demand for comprehensive network management solutions.

Growing Demand for Network Efficiency

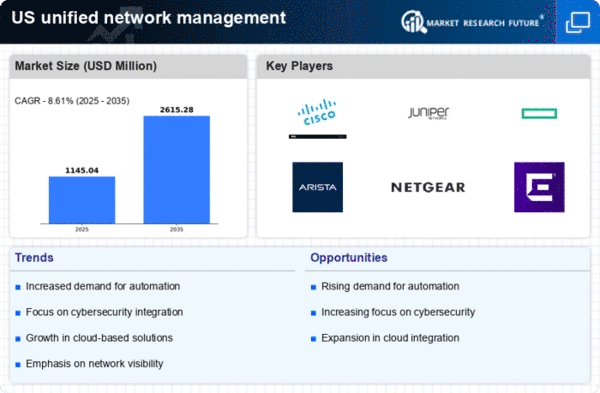

The unified network-management market is experiencing a notable surge in demand for enhanced network efficiency. Organizations are increasingly seeking solutions that streamline operations, reduce latency, and optimize resource allocation. This trend is driven by the need for businesses to maintain competitive advantages in a rapidly evolving digital landscape. According to recent data, companies that implement unified network management solutions can achieve up to 30% improvement in operational efficiency. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 12% over the next five years. This growth reflects the critical role that efficient network management plays in supporting business objectives and ensuring seamless connectivity across various platforms.

Regulatory Compliance and Data Privacy

Regulatory compliance and data privacy concerns are increasingly influencing the unified network-management market. Organizations are required to adhere to various regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). These regulations necessitate robust network management solutions that ensure data security and compliance. As businesses navigate the complexities of regulatory frameworks, the demand for unified network management systems that offer comprehensive compliance features is expected to rise. This trend is particularly relevant in sectors such as finance and healthcare, where data breaches can result in substantial penalties. The market is likely to see a growth trajectory as organizations prioritize compliance and invest in solutions that mitigate risks associated with data management.