Rising E-commerce Activities

The surge in e-commerce activities in the US has a profound impact on the truck rental market. As online shopping continues to grow, businesses require efficient logistics solutions to meet consumer demands. This trend necessitates the use of rental trucks for last-mile delivery, enabling companies to transport goods swiftly and effectively. In 2025, the e-commerce sector is projected to account for approximately 20% of total retail sales, driving the need for flexible transportation options. Consequently, the truck rental market is likely to experience increased demand as businesses seek to optimize their supply chains and enhance delivery capabilities.

Shifts in Consumer Preferences

Consumer preferences are evolving, with a growing inclination towards rental services over ownership. This shift is particularly evident in the truck rental market, where individuals and businesses are increasingly opting for rental solutions to avoid the costs associated with ownership, such as maintenance and insurance. The truck rental market is likely to capitalize on this trend by promoting the advantages of rental services, including flexibility and cost-effectiveness. As consumers become more budget-conscious, the appeal of renting trucks for short-term needs may continue to rise, potentially reshaping market dynamics.

Increased Construction Activities

The construction sector in the US is experiencing a resurgence, which significantly influences the truck rental market. With infrastructure projects and residential developments on the rise, construction companies require reliable transportation for equipment and materials. In 2025, the construction industry is anticipated to grow by 5%, further driving the demand for rental trucks. This trend suggests that the truck rental market will benefit from partnerships with construction firms, providing specialized vehicles that can accommodate heavy loads and facilitate project timelines. The ability to offer flexible rental terms may also enhance competitiveness in this sector.

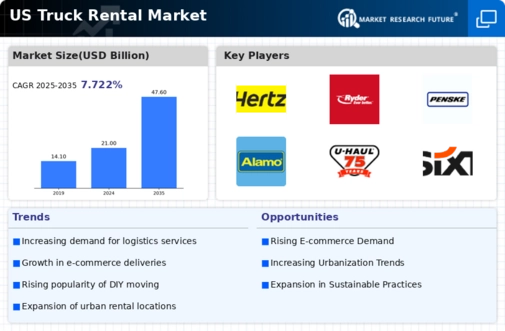

Urbanization and Population Growth

Urbanization trends in the US are contributing to the expansion of the truck rental market. As more individuals relocate to urban areas, the demand for moving services rises, particularly for residential relocations and commercial expansions. The US Census Bureau indicates that urban areas are expected to grow by 2% annually, leading to heightened demand for rental trucks. This growth presents opportunities for truck rental companies to cater to both residential and commercial clients. The truck rental market must adapt to these demographic shifts by offering tailored solutions that meet the unique needs of urban dwellers and businesses.

Technological Advancements in Fleet Management

Technological advancements are revolutionizing the truck rental market, particularly in fleet management. Innovations such as GPS tracking, telematics, and mobile applications enhance operational efficiency and customer experience. These technologies allow rental companies to monitor vehicle performance, optimize routes, and provide real-time updates to customers. As the truck rental market embraces these advancements, it may lead to improved service delivery and increased customer satisfaction. Furthermore, the integration of technology can streamline rental processes, making it easier for customers to access and manage their rentals, thereby fostering loyalty and repeat business.