Integration of Mobile Technology

The travel management-software market is increasingly influenced by the integration of mobile technology, which enhances the travel experience for users. With the proliferation of smartphones, travelers now expect seamless access to travel information and booking capabilities on-the-go. In 2025, it is anticipated that mobile bookings will account for over 50% of all travel reservations in the US. This shift is prompting travel management software providers to develop mobile-friendly platforms that offer real-time updates, itinerary management, and expense tracking. By leveraging mobile technology, companies can improve traveler engagement and satisfaction, ultimately leading to more efficient travel management processes. The travel management-software market is thus evolving to meet these demands, ensuring that users have the tools they need at their fingertips.

Increased Corporate Travel Spending

The travel management-software market is experiencing a notable surge in demand, driven by increased corporate travel spending. As businesses recognize the importance of face-to-face interactions, travel budgets are expanding. In 2025, corporate travel spending in the US is projected to reach approximately $200 billion, reflecting a growth rate of around 10% from previous years. This uptick in expenditure necessitates efficient travel management solutions to streamline processes, enhance compliance, and optimize costs. Consequently, organizations are increasingly adopting travel management software to manage their travel programs effectively, ensuring that they can accommodate the growing travel needs of their employees while maintaining budgetary control. The travel management-software market is thus positioned to benefit from this trend, as companies seek to leverage technology to enhance their travel operations.

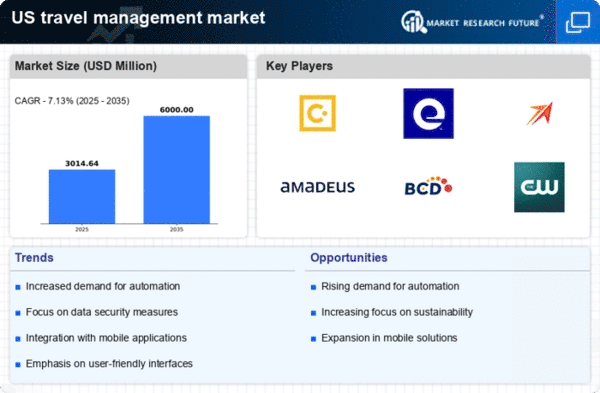

Focus on Data Security and Compliance

In an era where data breaches are increasingly common, the travel management-software market is witnessing a heightened focus on data security and compliance. Organizations are prioritizing the protection of sensitive travel data, which includes personal information and payment details. In 2025, it is projected that 70% of companies will implement stricter data security measures in their travel management processes. This trend is driving the demand for software solutions that offer robust security features, such as encryption and secure payment processing. Additionally, compliance with regulations such as GDPR and CCPA is becoming essential for travel management software providers. As a result, companies are seeking solutions that not only streamline travel operations but also ensure that they adhere to legal requirements, thereby fostering trust and reliability in the travel management-software market.

Demand for Remote Work Travel Solutions

The rise of remote work has led to a unique demand for travel management-software market solutions tailored for hybrid work environments. As employees split their time between home and the office, companies are exploring travel options that accommodate this flexibility. In 2025, it is estimated that 30% of the US workforce will engage in hybrid work, prompting organizations to seek software that can manage travel arrangements efficiently. This shift necessitates tools that can handle complex itineraries, provide real-time updates, and ensure compliance with company policies. The travel management-software market is thus adapting to meet these evolving needs, offering features that cater specifically to the requirements of remote and hybrid workers, thereby enhancing overall productivity and employee satisfaction.

Emphasis on Customization and Personalization

The travel management-software market is witnessing a growing emphasis on customization and personalization to meet the diverse needs of travelers. As organizations recognize that each traveler has unique preferences and requirements, there is a push for software solutions that can be tailored accordingly. In 2025, it is estimated that 40% of companies will prioritize personalized travel experiences for their employees. This trend is driving the development of software features that allow for customizable itineraries, preferred vendor selections, and personalized communication. By offering tailored solutions, travel management software can enhance user satisfaction and improve compliance with travel policies. Consequently, the travel management-software market is adapting to these expectations, fostering a more user-centric approach to travel management.