Rising Awareness of Power Quality

The transfer switch market is likely to benefit from a growing awareness of power quality issues among consumers and businesses. As reliance on electronic devices and sensitive equipment increases, the demand for stable and uninterrupted power supply becomes critical. In 2025, it is estimated that power quality problems could cost U.S. businesses upwards of $150 billion annually. This financial impact highlights the importance of transfer switches in mitigating power disruptions and ensuring operational continuity. Consequently, the transfer switch market is expected to see heightened demand as organizations prioritize investments in power management solutions to safeguard their operations.

Growing Infrastructure Investments

The transfer switch market is experiencing a notable boost due to increasing investments in infrastructure across the United States. Government initiatives aimed at modernizing power grids and enhancing energy efficiency are driving demand for reliable power management solutions. In 2025, infrastructure spending is projected to reach approximately $1 trillion, with a significant portion allocated to energy projects. This trend indicates a growing need for transfer switches, which are essential for ensuring seamless power transitions during outages. As utilities and commercial sectors prioritize resilience, the transfer switch market is likely to benefit from these investments, positioning itself as a critical component in the evolving energy landscape.

Increased Focus on Energy Security

The transfer switch market is influenced by a heightened focus on energy security in the United States. With the increasing frequency of natural disasters and cyber threats, businesses and governments are prioritizing measures to protect their energy infrastructure. Transfer switches are essential for maintaining power supply during emergencies, making them a critical component of energy security strategies. In 2025, investments in energy resilience are projected to exceed $50 billion, further driving the demand for transfer switches. This trend indicates that the transfer switch market will likely expand as stakeholders seek to enhance their preparedness against potential disruptions.

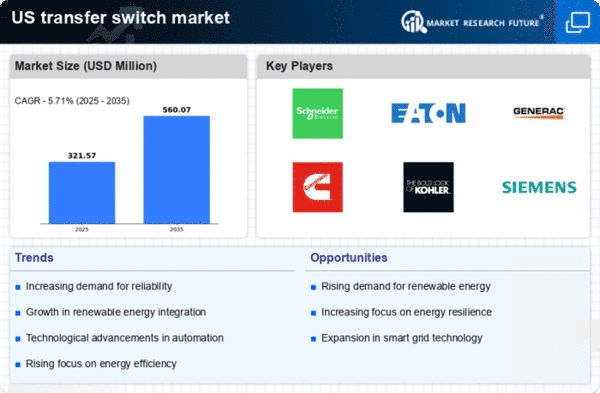

Surge in Renewable Energy Adoption

The transfer switch market is poised for growth as the adoption of renewable energy sources accelerates in the United States. With a shift towards solar and wind energy, the need for efficient power management systems becomes increasingly apparent. Transfer switches play a vital role in integrating renewable energy into existing grids, allowing for smooth transitions between different power sources. In 2025, renewable energy is expected to account for over 30% of the total energy mix, necessitating advanced transfer switch solutions. This trend suggests that the transfer switch market will expand as stakeholders seek to optimize energy distribution and enhance grid reliability.

Technological Integration in Power Systems

The transfer switch market is evolving due to the integration of advanced technologies in power systems. Innovations such as smart grids and IoT-enabled devices are transforming how energy is managed and distributed. Transfer switches equipped with smart technology can provide real-time monitoring and automated control, enhancing operational efficiency. As the U.S. energy landscape becomes increasingly digitized, the demand for technologically advanced transfer switches is expected to rise. In 2025, the market for smart transfer switches could grow by over 20%, reflecting the industry's shift towards more intelligent and responsive power management solutions.