Growing Industrial Applications

The thermoelectric generator market is witnessing a surge in demand from various industrial applications. Industries such as manufacturing, automotive, and aerospace are increasingly utilizing thermoelectric generators to recover waste heat and convert it into electricity. This trend is particularly evident in the automotive sector, where thermoelectric generators can enhance fuel efficiency by harnessing waste heat from engines. The market for thermoelectric generators in industrial applications is projected to reach approximately $500 million by 2030, reflecting a robust growth trajectory. As companies seek to optimize energy use and reduce operational costs, the integration of thermoelectric generators is likely to become a standard practice in energy management strategies.

Advancements in Material Science

Recent advancements in material science are significantly impacting the thermoelectric generator market. The development of new materials, such as nanostructured thermoelectric materials, has led to improved efficiency and performance of thermoelectric generators. These innovations allow for better heat-to-electricity conversion rates, which can exceed 10% in some cases. As industries in the US strive for higher energy efficiency, the demand for these advanced thermoelectric generators is expected to increase. Furthermore, the potential for lower production costs associated with these new materials may enhance market accessibility, encouraging broader adoption across various sectors, including automotive and industrial applications.

Rising Awareness of Energy Costs

The rising awareness of energy costs among consumers and businesses is driving the thermoelectric generator market. As energy prices continue to fluctuate, there is an increasing incentive for industries to invest in technologies that can reduce energy consumption and costs. Thermoelectric generators offer a viable solution by converting waste heat into electricity, thereby lowering overall energy expenses. This trend is particularly relevant in sectors with high energy demands, such as manufacturing and data centers. The potential for significant cost savings, estimated at up to 30% in some applications, is likely to propel the adoption of thermoelectric generators, making them an attractive option for energy-conscious organizations.

Increasing Focus on Renewable Energy Sources

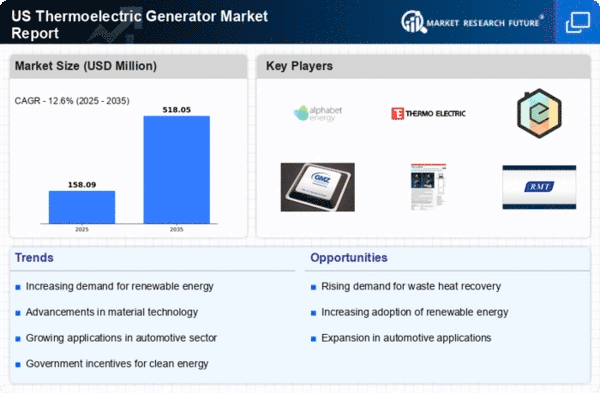

The thermoelectric generator market is experiencing a notable shift as the focus on renewable energy sources intensifies. With the US government aiming to reduce greenhouse gas emissions by 50-52% by 2030, there is a growing emphasis on integrating thermoelectric generators into renewable energy systems. These devices can convert waste heat from solar panels and industrial processes into usable electricity, thereby enhancing overall energy efficiency. The market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by this increasing focus on sustainability. As industries seek to comply with stringent environmental regulations, the adoption of thermoelectric generators is likely to rise, positioning them as a crucial component in the transition towards a greener energy landscape.

Regulatory Pressures for Emission Reductions

Regulatory pressures for emission reductions are significantly influencing the thermoelectric generator market. The US government has implemented various regulations aimed at curbing emissions from industrial processes and power generation. These regulations create a favorable environment for the adoption of thermoelectric generators, which can help industries meet compliance requirements by converting waste heat into usable energy. The market is expected to benefit from these regulatory frameworks, as companies seek to avoid penalties and enhance their sustainability profiles. With the potential to reduce emissions by up to 20% in certain applications, thermoelectric generators are likely to play a pivotal role in helping industries achieve their environmental goals.