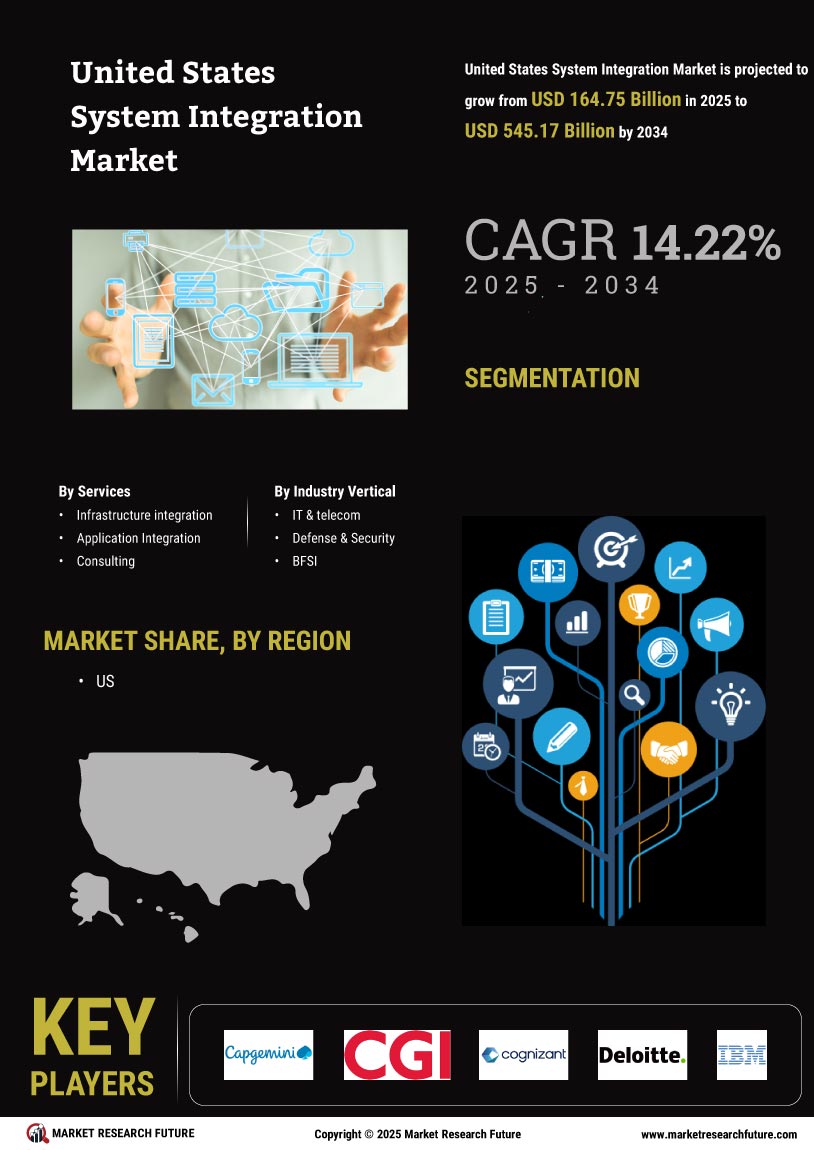

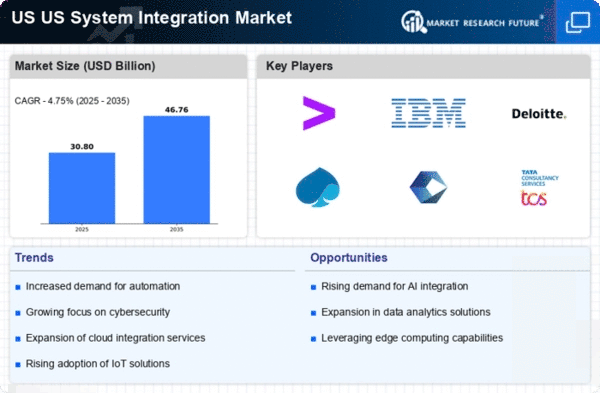

Growing Demand for Automation

The US System Integration Market is experiencing a notable surge in demand for automation solutions across various sectors. Organizations are increasingly seeking to streamline operations, reduce costs, and enhance efficiency through automated processes. According to recent data, the automation market in the US is projected to reach approximately 200 billion USD by 2026, indicating a robust growth trajectory. This trend is particularly evident in manufacturing, logistics, and healthcare, where system integration plays a crucial role in connecting disparate systems and enabling seamless data flow. As businesses recognize the potential of automation to drive productivity, the integration of automated systems becomes paramount, thereby propelling the growth of the US System Integration Market.

Rise of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices is reshaping the landscape of the US System Integration Market. With millions of connected devices generating vast amounts of data, organizations are increasingly seeking integrated solutions to manage and analyze this information effectively. The IoT market in the US is expected to exceed 1 trillion USD by 2026, highlighting the immense potential for system integration services that facilitate seamless connectivity and data exchange. Industries such as smart cities, agriculture, and transportation are leveraging IoT technologies to enhance operational efficiency and decision-making. Consequently, the demand for system integration that supports IoT ecosystems is likely to drive growth in the US System Integration Market.

Regulatory Compliance and Standards

The US System Integration Market is significantly influenced by the need for regulatory compliance and adherence to industry standards. Various sectors, including finance, healthcare, and telecommunications, are subject to stringent regulations that necessitate the integration of compliant systems. For instance, the Health Insurance Portability and Accountability Act (HIPAA) mandates secure handling of patient data, prompting healthcare organizations to invest in integrated solutions that ensure compliance. Furthermore, the Federal Information Security Management Act (FISMA) requires federal agencies to implement robust security measures, driving demand for system integration services that align with these regulations. As organizations strive to meet compliance requirements, the US System Integration Market is likely to witness sustained growth.

Emphasis on Enhanced Customer Experience

The US System Integration Market is witnessing a heightened focus on enhancing customer experience as organizations strive to differentiate themselves in a competitive landscape. Companies are increasingly investing in integrated systems that facilitate personalized interactions and streamline customer service processes. According to industry reports, organizations that prioritize customer experience are likely to achieve revenue growth of up to 10 percent annually. This trend is particularly evident in retail and e-commerce sectors, where integrated solutions enable seamless omnichannel experiences. As businesses recognize the importance of customer satisfaction in driving loyalty and retention, the demand for system integration services that enhance customer engagement is expected to grow, further propelling the US System Integration Market.

Focus on Data Analytics and Business Intelligence

The emphasis on data analytics and business intelligence is a key driver in the US System Integration Market. Organizations are increasingly recognizing the value of data-driven decision-making, prompting investments in integrated systems that enable comprehensive data analysis. The business intelligence market in the US is projected to reach approximately 30 billion USD by 2026, underscoring the growing importance of analytics in various sectors. System integration plays a vital role in consolidating data from multiple sources, allowing organizations to derive actionable insights and enhance strategic planning. As businesses strive to remain competitive in a data-centric environment, the demand for integrated analytics solutions is expected to bolster the US System Integration Market.