Emergence of Hybrid IT Environments

The emergence of hybrid IT environments is significantly influencing the Europe System Integration Market. As organizations increasingly adopt a mix of on-premises and cloud-based solutions, the need for effective system integration becomes crucial. This hybrid approach allows businesses to leverage the benefits of both environments, but it also introduces complexities in data management and system interoperability. Recent surveys indicate that nearly 60 percent of European enterprises are operating in hybrid IT settings, highlighting the demand for integration solutions that can bridge the gap between disparate systems. As companies strive to optimize their IT infrastructure and enhance operational efficiency, the role of system integration in facilitating seamless communication and data exchange across hybrid environments is likely to grow. Thus, the rise of hybrid IT environments is poised to be a significant driver of the Europe System Integration Market.

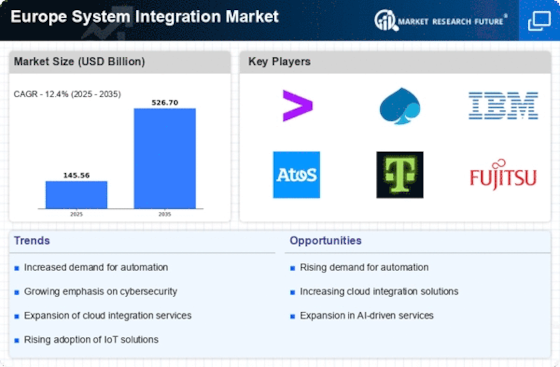

Growing Demand for Digital Transformation

The Europe System Integration Market is experiencing a notable surge in demand for digital transformation initiatives. Organizations across various sectors are increasingly recognizing the necessity to modernize their operations and enhance customer experiences through integrated systems. According to recent data, approximately 70 percent of European enterprises are prioritizing digital transformation strategies, which often necessitate robust system integration solutions. This trend is driven by the need for improved efficiency, agility, and competitiveness in a rapidly evolving digital landscape. As businesses strive to leverage emerging technologies such as artificial intelligence and the Internet of Things, the role of system integration becomes pivotal in ensuring seamless connectivity and data flow across diverse platforms. Consequently, this growing demand for digital transformation is likely to propel the Europe System Integration Market forward, fostering innovation and collaboration among technology providers.

Regulatory Compliance and Data Protection

In the context of the Europe System Integration Market, regulatory compliance and data protection have emerged as critical drivers. The implementation of stringent regulations, such as the General Data Protection Regulation (GDPR), has compelled organizations to adopt comprehensive system integration solutions that ensure data security and compliance. As businesses navigate the complexities of regulatory frameworks, the need for integrated systems that facilitate secure data handling and reporting becomes paramount. Recent statistics indicate that over 80 percent of European companies are investing in compliance-related technologies, which often include system integration components. This focus on regulatory adherence not only mitigates risks associated with data breaches but also enhances customer trust and loyalty. Therefore, the emphasis on regulatory compliance is likely to continue shaping the Europe System Integration Market, as organizations seek to align their operations with evolving legal requirements.

Increased Investment in Smart Technologies

The Europe System Integration Market is witnessing a significant uptick in investment directed towards smart technologies. As industries increasingly adopt automation and smart solutions, the demand for system integration services that can seamlessly connect these technologies is on the rise. For instance, the European Union has allocated substantial funding towards initiatives aimed at promoting smart manufacturing and smart cities, which inherently require sophisticated integration of various systems. Recent reports suggest that investments in smart technologies across Europe are projected to exceed 200 billion euros by 2027. This influx of capital is likely to stimulate growth within the system integration sector, as companies seek to implement integrated solutions that enhance operational efficiency and drive innovation. Consequently, the focus on smart technologies is expected to be a key driver of the Europe System Integration Market, fostering collaboration between technology providers and end-users.

Focus on Sustainability and Green Technologies

The focus on sustainability and green technologies is becoming increasingly prominent within the Europe System Integration Market. As European nations commit to ambitious environmental targets, organizations are seeking integrated solutions that support sustainable practices and reduce carbon footprints. This shift is evident in the growing adoption of energy-efficient systems and renewable energy sources, which often require sophisticated integration to function optimally. Recent data suggests that investments in green technologies across Europe are expected to reach 150 billion euros by 2025. This trend not only aligns with regulatory pressures but also reflects changing consumer preferences towards environmentally responsible practices. Consequently, the emphasis on sustainability is likely to drive demand for system integration solutions that facilitate the implementation of green technologies, thereby shaping the future landscape of the Europe System Integration Market.