Evolving Food and Beverage Trends

Evolving food and beverage trends are significantly impacting the sweeteners market. The increasing popularity of health-oriented diets, such as keto and paleo, has led to a surge in demand for sweeteners that align with these lifestyles. Market analysis indicates that products labeled as low-carb or sugar-free are gaining traction, with sales in this category expected to rise by 15% in the coming years. This trend compels manufacturers to adapt their product lines to meet consumer expectations, thereby driving innovation and growth within the sweeteners market. As consumers continue to prioritize health and wellness, the demand for suitable sweetening options is likely to remain robust.

Innovation in Product Development

Innovation in product development is a significant driver influencing the sweeteners market. Companies are increasingly investing in research and development to create new sweetening agents that cater to diverse consumer preferences. This includes the introduction of novel sweeteners derived from natural sources, which are perceived as healthier alternatives. Market data suggests that the segment of natural sweeteners is expected to capture a larger share, potentially reaching 30% of the overall market by 2026. The continuous evolution of product formulations not only enhances the appeal of sweeteners but also addresses the growing demand for clean-label products, thereby fostering growth within the sweeteners market.

Health Consciousness Among Consumers

The increasing health consciousness among consumers appears to be a pivotal driver for the sweeteners market. As individuals become more aware of the implications of sugar consumption on health, there is a noticeable shift towards alternative sweeteners. This trend is reflected in market data, indicating that the demand for low-calorie and natural sweeteners has surged, with a projected growth rate of approximately 8% annually. Consumers are actively seeking products that align with their health goals, which has led to a diversification of offerings in the sweeteners market. Manufacturers are responding by innovating and reformulating products to meet these evolving preferences, thereby expanding their market reach and enhancing competitiveness.

Rising Demand for Sugar Alternatives

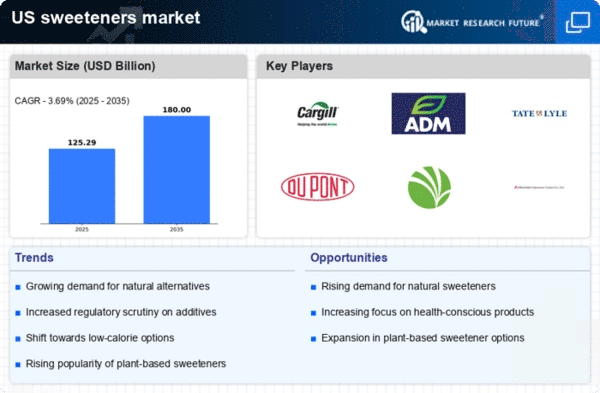

The rising demand for sugar alternatives is a crucial factor propelling the sweeteners market. As consumers increasingly seek to reduce their sugar intake due to health concerns, the market for sweeteners is expanding. Reports indicate that the market for sugar substitutes is projected to grow at a compound annual growth rate (CAGR) of around 6% over the next five years. This shift is driven by a combination of factors, including the desire for weight management and the prevalence of diabetes. Consequently, manufacturers are focusing on developing a wider range of sweetening options, which is likely to enhance the overall market landscape and provide consumers with more choices in the sweeteners market.

Regulatory Changes and Labeling Requirements

Regulatory changes and labeling requirements are emerging as influential drivers in the sweeteners market. As government agencies implement stricter guidelines regarding food labeling and health claims, manufacturers are compelled to reformulate their products to comply. This has led to an increased focus on transparency and the use of natural ingredients, which resonates with consumer preferences. Market data suggests that products with clear labeling and health benefits are more likely to succeed, potentially increasing their market share by 20% over the next few years. Consequently, the sweeteners market is witnessing a shift towards compliance-driven innovation, as companies strive to meet regulatory standards while catering to consumer demands.