Regulatory Compliance and Standards

Regulatory compliance and adherence to industry standards are emerging as significant drivers in the supply chain-analytics market. As businesses face increasing scrutiny regarding their supply chain practices, the need for analytics solutions that ensure compliance is paramount. Companies are investing in analytics tools that help them monitor and report on compliance metrics effectively. The market is expected to grow as organizations seek to avoid penalties and enhance their reputation by adhering to regulations. Furthermore, analytics can assist in identifying areas of non-compliance, enabling firms to take corrective actions promptly. This focus on regulatory compliance is likely to drive demand for advanced analytics solutions within the supply chain-analytics market, as businesses strive to maintain operational integrity and transparency.

Integration of Advanced Technologies

The integration of advanced technologies such as IoT, blockchain, and big data analytics is significantly influencing the supply chain-analytics market. These technologies facilitate seamless data exchange and enhance visibility across the supply chain. For instance, IoT devices enable real-time tracking of goods, while blockchain ensures data integrity and security. The adoption of these technologies is expected to increase operational efficiency by up to 30%, as organizations can monitor their supply chains more effectively. Furthermore, the ability to analyze vast amounts of data allows companies to make informed decisions, thereby driving growth in the supply chain-analytics market. As businesses continue to embrace digital transformation, the demand for integrated analytics solutions is likely to rise, further propelling market expansion.

Focus on Risk Management and Resilience

In an increasingly volatile business landscape, the focus on risk management and resilience is becoming a critical driver for the supply chain-analytics market. Companies are prioritizing the identification and mitigation of risks associated with supply chain disruptions. The market is witnessing a shift towards analytics solutions that provide insights into potential vulnerabilities and enable proactive measures. Research indicates that organizations utilizing advanced analytics for risk management can reduce supply chain disruptions by up to 40%. This emphasis on resilience is prompting businesses to invest in analytics tools that enhance their ability to adapt to unforeseen challenges, thereby fostering growth in the supply chain-analytics market. As firms seek to build more robust supply chains, the demand for sophisticated analytics solutions is expected to increase.

Rising Demand for Data-Driven Decision Making

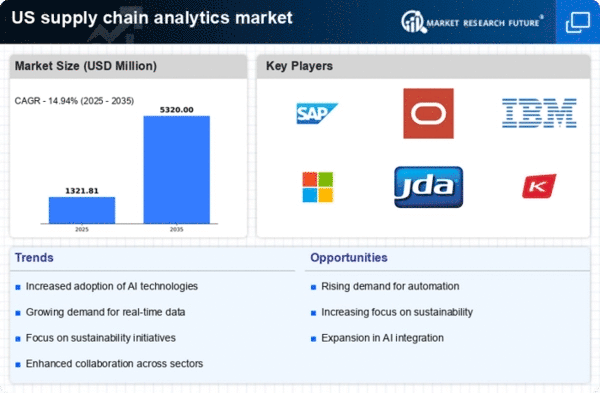

The supply chain-analytics market is experiencing a notable surge in demand for data-driven decision-making processes. Organizations are increasingly recognizing the value of leveraging analytics to enhance operational efficiency and optimize supply chain performance. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for real-time insights that enable businesses to respond swiftly to market fluctuations. Companies are investing in advanced analytics tools to gain a competitive edge, thereby propelling the supply chain-analytics market forward. The integration of predictive analytics allows firms to anticipate demand patterns, manage inventory levels effectively, and reduce operational costs, which is crucial in today's fast-paced business environment.

Growing Emphasis on Customer-Centric Supply Chains

The supply chain-analytics market is being driven by a growing emphasis on customer-centric supply chains. Businesses are increasingly recognizing the importance of aligning their supply chain strategies with customer preferences and expectations. This shift is leading to the adoption of analytics tools that provide insights into consumer behavior and demand trends. Companies that leverage analytics to enhance customer satisfaction can potentially increase their revenue by 15% or more. By utilizing data to tailor their offerings and improve service levels, organizations are better positioned to meet customer needs. This focus on customer-centricity is likely to propel the supply chain-analytics market as firms seek to enhance their competitive advantage through improved customer engagement and satisfaction.