Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the stroke diagnosis-and-treatment market. According to the National Health Expenditure Accounts, healthcare spending is projected to grow at an average rate of 5.4% annually, reaching approximately $6 trillion by 2027. This rise in expenditure reflects a growing commitment to improving healthcare services, including those related to stroke diagnosis and treatment. As healthcare budgets expand, hospitals and clinics are more likely to invest in advanced diagnostic technologies and treatment options, thereby enhancing their capabilities to manage stroke cases. This trend not only improves patient care but also stimulates growth within the stroke diagnosis-and-treatment market.

Increasing Incidence of Stroke

The rising incidence of stroke in the US is a critical driver for the stroke diagnosis-and-treatment market. According to the Centers for Disease Control and Prevention (CDC), stroke is the fifth leading cause of death in the country, with approximately 795,000 individuals experiencing a stroke annually. This alarming statistic underscores the urgent need for effective diagnostic and treatment solutions. As the population ages, the prevalence of risk factors such as hypertension, diabetes, and obesity continues to escalate, further contributing to the growing demand for stroke-related healthcare services. Consequently, healthcare providers are increasingly investing in advanced diagnostic tools and treatment modalities to address this pressing public health issue, thereby propelling the stroke diagnosis-and-treatment market forward.

Growing Awareness and Education

There is a notable increase in public awareness and education regarding stroke symptoms and risk factors, which is positively influencing the stroke diagnosis-and-treatment market. Campaigns led by organizations such as the American Stroke Association aim to educate the public about recognizing stroke symptoms, leading to earlier diagnosis and treatment. This heightened awareness is crucial, as timely intervention can significantly reduce the long-term effects of stroke. Furthermore, healthcare professionals are increasingly trained to identify and manage stroke cases effectively, which enhances the overall quality of care. As awareness continues to grow, the demand for diagnostic and treatment services is likely to rise, thereby propelling the stroke diagnosis-and-treatment market.

Advancements in Imaging Technologies

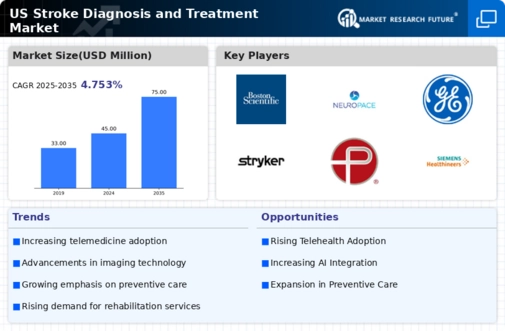

Innovations in imaging technologies are significantly enhancing the capabilities of the stroke diagnosis-and-treatment market. Techniques such as magnetic resonance imaging (MRI) and computed tomography (CT) scans have evolved, allowing for quicker and more accurate identification of stroke types and locations. The American Heart Association emphasizes that timely imaging is crucial for effective treatment, particularly in acute stroke cases. As a result, hospitals and clinics are adopting state-of-the-art imaging equipment, which not only improves patient outcomes but also drives market growth. The integration of artificial intelligence in imaging analysis is also emerging, potentially streamlining workflows and increasing diagnostic accuracy, thus further stimulating the stroke diagnosis-and-treatment market.

Regulatory Support for Innovative Treatments

Regulatory bodies in the US are increasingly supportive of innovative treatments for stroke, which serves as a vital driver for the stroke diagnosis-and-treatment market. The Food and Drug Administration (FDA) has expedited the approval process for novel therapies, including thrombectomy devices and clot-busting medications. This regulatory environment encourages pharmaceutical and medical device companies to invest in research and development, leading to the introduction of advanced treatment options. As new therapies become available, healthcare providers are better equipped to manage stroke cases effectively, which is likely to enhance patient outcomes and drive market growth. The ongoing collaboration between regulatory agencies and industry stakeholders is expected to foster further innovation in the stroke diagnosis-and-treatment market.