Rising Healthcare Expenditure

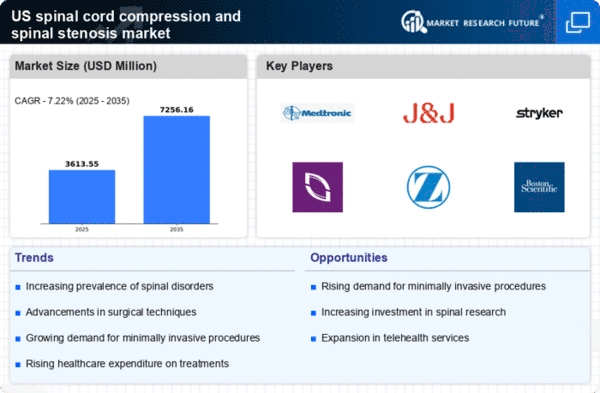

Increasing healthcare expenditure in the US is a significant driver for the spinal cord-compression-spinal-stenosis market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in spinal health and related treatments. This financial commitment allows for the development and adoption of new therapies, including advanced imaging technologies and surgical techniques. As patients gain access to better healthcare services, the demand for effective treatments for spinal stenosis is likely to rise. Consequently, the spinal cord-compression-spinal-stenosis market may benefit from this upward trend in healthcare spending, leading to enhanced treatment options and improved patient outcomes.

Advancements in Surgical Techniques

Innovations in surgical techniques are transforming the spinal cord-compression-spinal-stenosis market. Minimally invasive procedures, such as endoscopic spine surgery, are gaining traction due to their reduced recovery times and lower complication rates. The American Academy of Orthopaedic Surgeons reports that these advancements can lead to quicker patient recovery and improved outcomes. As more surgeons adopt these techniques, the market may experience a surge in demand for surgical interventions. Furthermore, the introduction of robotic-assisted surgeries could enhance precision and efficacy, potentially driving market growth as patients seek out these advanced treatment options.

Emerging Non-Surgical Treatment Options

The emergence of non-surgical treatment options is reshaping the spinal cord-compression-spinal-stenosis market. Techniques such as spinal injections, physical therapy, and alternative therapies are gaining popularity as patients seek less invasive solutions. The National Institute of Neurological Disorders and Stroke indicates that many patients respond well to conservative management, which can delay or eliminate the need for surgery. This trend may lead to a broader acceptance of non-surgical interventions, potentially expanding the market as healthcare providers offer a wider range of treatment modalities. As patients become more informed about their options, the demand for these alternatives is likely to increase.

Aging Population and Increased Incidence

The aging population in the US is a critical driver for the spinal cord-compression-spinal-stenosis market. As individuals age, the likelihood of developing spinal stenosis increases due to degenerative changes in the spine. According to the US Census Bureau, by 2030, approximately 20% of the population will be 65 years or older, leading to a higher prevalence of spinal disorders. This demographic shift suggests a growing demand for treatment options, including surgical interventions and conservative management strategies. The spinal cord-compression-spinal-stenosis market is likely to expand as healthcare providers seek to address the needs of this aging cohort, potentially increasing market revenues significantly.

Increased Focus on Rehabilitation Services

The growing emphasis on rehabilitation services is influencing the spinal cord-compression-spinal-stenosis market. As healthcare providers recognize the importance of post-operative care and rehabilitation, there is a shift towards integrated treatment approaches. Rehabilitation programs that include physical therapy and pain management are becoming essential components of spinal stenosis treatment plans. This trend may lead to increased patient satisfaction and better long-term outcomes, thereby driving demand for comprehensive care solutions. The spinal cord-compression-spinal-stenosis market could see growth as more facilities expand their rehabilitation offerings to meet the needs of patients recovering from spinal procedures.