Focus on Pediatric Speech Therapy

The emphasis on pediatric speech therapy is becoming increasingly pronounced within the US Speech Therapy Service Market. Early intervention is recognized as a crucial factor in addressing speech and language delays in children. As parents and educators become more informed about the benefits of early speech therapy, there is a growing demand for specialized services tailored to children. Data suggests that approximately 1 in 12 children in the US experience a speech or language disorder, underscoring the need for targeted therapeutic interventions. This focus on pediatric care is likely to drive the expansion of the US Speech Therapy Service Market, as more resources are allocated to support the speech development of young children.

Aging Population and Associated Needs

The demographic shift towards an aging population in the United States is significantly influencing the US Speech Therapy Service Market. As the population ages, the prevalence of age-related speech and language disorders, such as aphasia and dysarthria, is expected to rise. The US Census Bureau projects that by 2030, all baby boomers will be over the age of 65, leading to an increased demand for specialized speech therapy services. This demographic trend suggests that healthcare providers and therapists will need to adapt their services to cater to the unique needs of older adults, thereby expanding the market for speech therapy services across the nation.

Growing Awareness of Speech Disorders

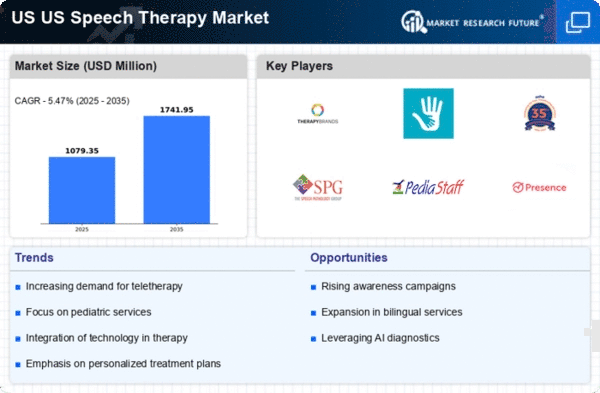

The US Speech Therapy Service Market is experiencing a notable increase in awareness regarding speech disorders among the general population. This heightened awareness is largely attributed to educational campaigns and advocacy groups that emphasize the importance of early diagnosis and intervention. As a result, more individuals are seeking professional help for speech-related issues, which is driving demand for speech therapy services. According to recent data, approximately 7.5 million Americans experience speech disorders, highlighting a substantial market potential. This growing recognition of speech disorders is likely to propel the US Speech Therapy Service Market forward, as more families and individuals prioritize access to therapeutic services.

Technological Advancements in Therapy Delivery

Technological innovations are reshaping the landscape of the US Speech Therapy Service Market. The integration of digital tools, such as mobile applications and teletherapy platforms, is enhancing the accessibility and effectiveness of speech therapy services. These advancements allow therapists to reach a broader audience, including those in remote areas who may have previously faced barriers to accessing care. Data indicates that teletherapy services have seen a significant uptick, with a reported increase of over 30% in usage among speech therapists in the past year. This trend suggests that technology will continue to play a pivotal role in the evolution of the US Speech Therapy Service Market, making services more efficient and user-friendly.

Increased Insurance Coverage for Therapy Services

The expansion of insurance coverage for speech therapy services is a critical driver of growth in the US Speech Therapy Service Market. Recent policy changes have led to more comprehensive coverage options for individuals requiring speech therapy, including those with developmental delays and acquired speech disorders. The Centers for Medicare and Medicaid Services (CMS) have also made strides in ensuring that speech therapy is recognized as a necessary service, which has encouraged more patients to seek treatment. This increased financial support is likely to enhance the market's growth trajectory, as more individuals can afford the necessary therapy services without facing prohibitive out-of-pocket costs.