Health Consciousness Among Consumers

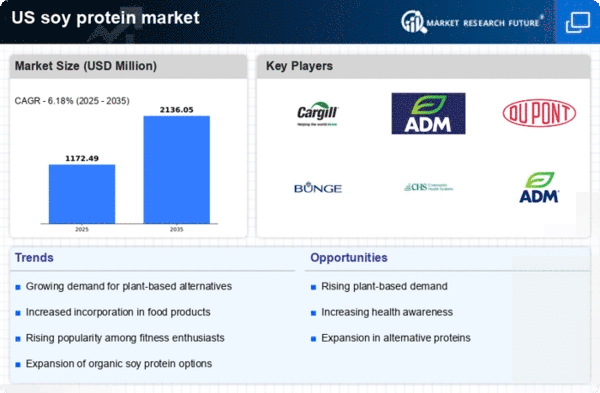

The increasing awareness of health and wellness among consumers appears to be a primary driver for the soy protein market. As individuals seek healthier dietary options, the demand for plant-based proteins, particularly soy protein, has surged. This trend is reflected in the market data, which indicates that the soy protein market is projected to grow at a CAGR of approximately 8% from 2025 to 2030. Consumers are increasingly opting for soy protein due to its high protein content, essential amino acids, and potential health benefits, such as lowering cholesterol levels. The soy protein market is thus witnessing a shift towards products that cater to health-conscious consumers, including protein bars, shakes, and meat alternatives. This growing focus on health is likely to continue influencing purchasing decisions, further propelling the market forward.

Increased Focus on Nutritional Labeling

The growing emphasis on nutritional labeling and transparency in food products is influencing the soy protein market. Consumers are becoming more discerning about the ingredients in their food, leading to a demand for clear and informative labeling. This trend is particularly relevant in the soy protein market, where consumers seek products that provide detailed nutritional information, including protein content, amino acid profiles, and allergen information. Regulatory bodies in the US are also tightening guidelines on food labeling, which may further drive manufacturers to enhance their product transparency. As a result, companies that prioritize clear labeling and provide comprehensive nutritional information are likely to gain a competitive edge in the soy protein market. This focus on transparency may also encourage more consumers to choose soy protein products, thereby contributing to market growth.

Rising Vegan and Vegetarian Populations

The notable increase in the number of individuals adopting vegan and vegetarian lifestyles is significantly impacting the soy protein market. As more consumers choose plant-based diets for ethical, environmental, or health reasons, the demand for soy protein products is expected to rise. Recent statistics suggest that approximately 6% of the US population identifies as vegan, with a growing number of individuals reducing meat consumption. This shift is driving innovation within the soy protein market, as manufacturers develop new products that appeal to these consumers. The versatility of soy protein allows it to be incorporated into various food items, from meat substitutes to dairy alternatives, thereby expanding its market reach. As the trend towards plant-based diets continues, the soy protein market is likely to experience sustained growth, catering to the evolving preferences of consumers.

Growing Demand for Sustainable Food Sources

The increasing demand for sustainable food sources is emerging as a significant driver for the soy protein market. As consumers become more environmentally conscious, they are seeking alternatives to animal-based proteins that have a lower environmental impact. Soy protein, being a plant-based option, aligns well with these sustainability goals. The soy protein market is responding to this demand by promoting the environmental benefits of soy cultivation, such as lower greenhouse gas emissions and reduced land use compared to traditional livestock farming. Market data indicates that consumers are willing to pay a premium for products that are marketed as sustainable, which could further enhance the growth of the soy protein market. This trend towards sustainability is likely to shape consumer preferences and purchasing behaviors in the coming years.

Technological Advancements in Food Processing

Technological advancements in food processing are playing a crucial role in shaping the soy protein market. Innovations in extraction and processing techniques have improved the quality and functionality of soy protein, making it more appealing to manufacturers and consumers alike. For instance, advancements in texturization processes allow for the creation of soy protein products that closely mimic the taste and texture of meat, thereby attracting a broader consumer base. The soy protein market is witnessing an influx of new product offerings, including ready-to-eat meals and snacks that utilize these advanced processing techniques. As technology continues to evolve, it is likely that the soy protein market will benefit from enhanced product quality and variety, further driving consumer interest and market expansion.