Rising Demand for Electric Vehicles

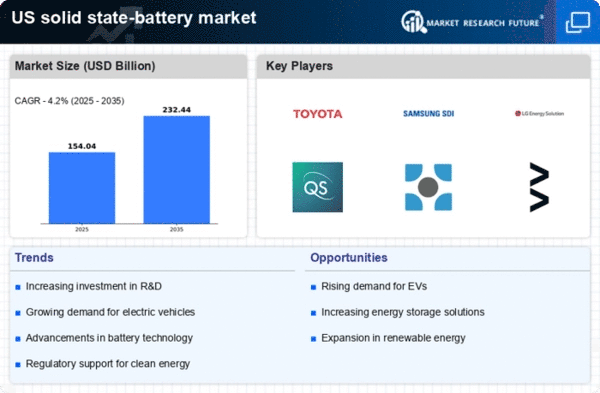

The increasing adoption of electric vehicles (EVs) in the US is a primary driver for the solid state-battery market. As consumers and manufacturers prioritize sustainability, the demand for batteries that offer higher energy density and faster charging times has surged. Solid state-batteries, with their potential to provide up to 50% more energy than traditional lithium-ion batteries, are becoming a preferred choice. In 2025, the EV market is projected to reach approximately $800 billion, with solid state-batteries expected to capture a significant share due to their enhanced safety and performance characteristics. This trend indicates a robust growth trajectory for the solid state-battery market, as automakers increasingly invest in this technology to meet consumer expectations and regulatory standards.

Government Incentives for Clean Energy

Government incentives aimed at promoting clean energy solutions are significantly influencing the solid state-battery market. Federal and state policies, including tax credits and grants for research and development, are encouraging companies to invest in solid state-battery technologies. The Biden administration's commitment to achieving a 50% reduction in greenhouse gas emissions by 2030 is likely to bolster the market, as it aligns with the transition to cleaner energy sources. In 2025, funding for clean energy initiatives is expected to exceed $100 billion, creating a favorable environment for the solid state-battery market to thrive. This support may accelerate the commercialization of solid state-batteries, making them more accessible to consumers and industries alike.

Growing Focus on Energy Storage Solutions

The increasing need for efficient energy storage solutions is driving the solid state-battery market. As renewable energy sources like solar and wind become more prevalent, the demand for reliable storage systems to manage energy supply and demand is rising. Solid state-batteries offer advantages such as higher energy density and longer cycle life, making them suitable for grid storage applications. The US energy storage market is projected to grow to $10 billion by 2026, with solid state-batteries likely playing a crucial role in this expansion. This trend suggests that the solid state-battery market will benefit from the broader shift towards sustainable energy practices and the need for advanced storage technologies.

Technological Innovations in Battery Design

Innovations in battery design and materials are propelling the solid state-battery market forward. Research and development efforts are focused on creating solid electrolytes that enhance conductivity and stability, which could lead to batteries with longer lifespans and improved safety profiles. For instance, advancements in lithium sulfide and ceramic materials are showing promise in achieving higher ionic conductivity. The solid state-battery market is likely to benefit from these technological breakthroughs, as they may reduce production costs and improve overall battery performance. As of 2025, the market is anticipated to grow at a CAGR of around 20%, driven by these innovations that address the limitations of conventional battery technologies.

Increased Investment in Research and Development

Investment in research and development (R&D) for solid state-battery technologies is a critical driver of market growth. Major automotive and technology companies are allocating substantial resources to explore new materials and manufacturing processes that enhance battery performance. In 2025, R&D spending in the solid state-battery market is expected to reach $5 billion, reflecting a strong commitment to innovation. This influx of capital is likely to accelerate the development of commercially viable solid state-batteries, addressing current limitations such as cost and scalability. As companies strive to bring advanced battery solutions to market, the solid state-battery market is poised for significant advancements and increased competitiveness.