Increased Military Spending

The smart textiles-for-military market is benefiting from increased military spending in the United States. The Department of Defense has allocated substantial budgets for research and development of advanced materials and technologies. In 2025, military spending is expected to exceed $800 billion, with a significant portion directed towards innovative solutions like smart textiles. This financial commitment reflects a strategic focus on enhancing soldier performance and safety through cutting-edge technology. As funding continues to flow into the development of smart textiles, manufacturers are likely to see a rise in demand for their products, further propelling the market's growth. The emphasis on modernization within the military underscores the potential for smart textiles to play a pivotal role in future defense strategies.

Advancements in Sensor Technology

The smart textiles-for-military market is experiencing a surge due to advancements in sensor technology. These innovations enable the integration of various sensors into fabrics, allowing for real-time monitoring of soldiers' physiological conditions. For instance, textiles can now measure heart rate, body temperature, and even stress levels, providing critical data to commanders. The market for wearable sensors is projected to reach $30 billion by 2026, indicating a robust growth trajectory. This integration not only enhances soldier safety but also improves operational efficiency, as commanders can make informed decisions based on real-time data. As the military seeks to enhance its capabilities, the demand for smart textiles equipped with advanced sensors is likely to increase, driving the market forward.

Growing Emphasis on Soldier Health and Safety

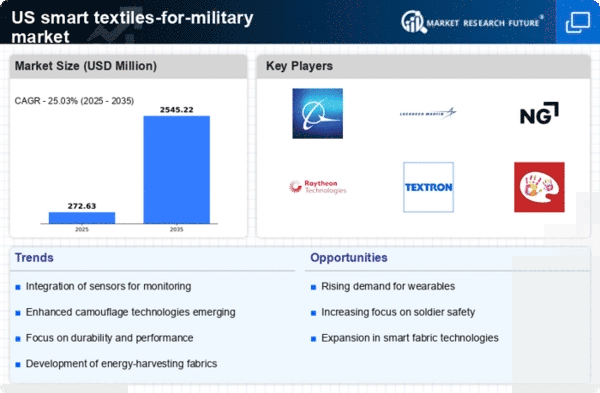

The smart textiles-for-military market is increasingly driven by a growing emphasis on soldier health and safety. Military organizations are recognizing the importance of monitoring soldiers' well-being in real-time, particularly in combat situations. Smart textiles can provide critical health data, enabling timely medical interventions and reducing the risk of injuries or fatalities. The market for health monitoring technologies is projected to grow at a CAGR of 25% over the next five years, indicating a strong demand for solutions that enhance soldier safety. This focus on health and safety aligns with broader military objectives to improve operational readiness and effectiveness. As a result, the integration of smart textiles into military uniforms is likely to become a standard practice, further expanding the market.

Technological Innovations in Material Science

The smart textiles-for-military market is significantly influenced by technological innovations in material science. Recent developments have led to the creation of fabrics that are not only lightweight and durable but also capable of conducting electricity and responding to environmental stimuli. These innovations allow for the development of textiles that can change properties based on temperature or moisture levels, enhancing comfort and functionality for soldiers. The market for advanced materials is expected to reach $50 billion by 2027, highlighting the potential for growth in this sector. As military applications for these innovative materials expand, the demand for smart textiles is likely to increase, driving further advancements in the industry.

Rising Demand for Customization and Personalization

The smart textiles-for-military market is witnessing a rising demand for customization and personalization of military gear. As soldiers operate in diverse environments, the need for tailored solutions that meet specific operational requirements is becoming more pronounced. Smart textiles can be designed to incorporate unique features such as camouflage patterns, temperature regulation, and moisture-wicking properties, catering to individual soldier needs. This trend is supported by a growing recognition that personalized gear can enhance performance and comfort. The customization market within the military sector is projected to grow by 15% annually, indicating a strong inclination towards bespoke solutions. As manufacturers respond to this demand, the smart textiles-for-military market is likely to expand, offering innovative products that align with the unique needs of modern soldiers.