Integration of Smart Home Ecosystems

The integration of smart home ecosystems represents a significant driver in the smart home market. Consumers increasingly prefer solutions that allow for seamless interaction among various devices, creating a cohesive smart home experience. This trend is evident in the rise of platforms that enable interoperability, such as Google Home and Amazon Alexa. As of 2025, it is estimated that over 50% of households in the US will have at least one smart home device, highlighting the growing acceptance of these ecosystems. The ability to control multiple devices through a single interface enhances user convenience and satisfaction, suggesting that the integration of smart home ecosystems will continue to propel market growth.

Rising Consumer Demand for Convenience

The smart home market experiences a notable surge in consumer demand for convenience-driven solutions. As lifestyles become increasingly hectic, homeowners seek technologies that simplify daily tasks. This trend is reflected in the growing adoption of smart appliances, such as smart refrigerators and automated lighting systems. According to recent data, the market for smart home devices is projected to reach approximately $135 billion by 2025, indicating a robust growth trajectory. The desire for seamless integration of devices, allowing for remote control and automation, propels this demand. Consumers are increasingly inclined to invest in smart home technologies that enhance their quality of life, suggesting a strong correlation between convenience and market expansion.

Sustainability and Eco-Friendly Solutions

Sustainability emerges as a crucial driver in the smart home market, as consumers increasingly prioritize eco-friendly solutions. The demand for energy-efficient devices, such as smart thermostats and energy monitoring systems, reflects a growing commitment to reducing carbon footprints. Recent studies suggest that nearly 70% of consumers are willing to invest in smart home technologies that promote sustainability. This trend aligns with broader environmental goals and governmental initiatives aimed at reducing energy consumption. As the market evolves, manufacturers are likely to focus on developing products that not only enhance convenience but also contribute to environmental sustainability, thereby driving growth in the smart home market.

Advancements in Home Automation Technology

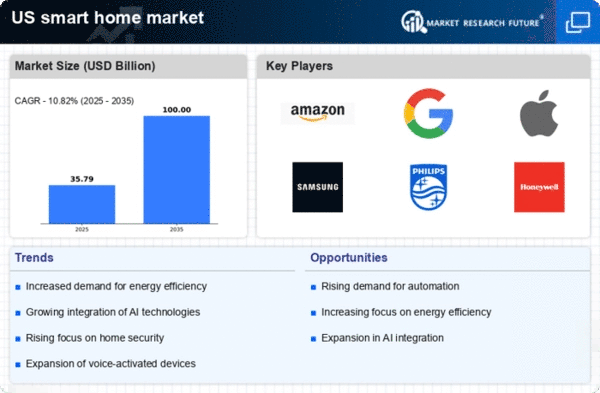

Technological advancements play a pivotal role in shaping the smart home market. Innovations in home automation systems, including voice-activated assistants and interconnected devices, enhance user experience and functionality. The integration of Internet of Things (IoT) technology facilitates real-time monitoring and control of home environments, which is appealing to tech-savvy consumers. As of 2025, the market is expected to witness a compound annual growth rate (CAGR) of around 25%, driven by these advancements. The proliferation of smart home platforms that allow for interoperability among devices further fuels this growth. Consequently, the evolution of home automation technology appears to be a key driver in the expansion of the smart home market.

Growing Awareness of Home Security Solutions

The increasing awareness of home security solutions significantly impacts the smart home market. Homeowners are becoming more conscious of the need for enhanced security measures, leading to a rise in the adoption of smart security systems. These systems often include smart cameras, motion detectors, and alarm systems that can be monitored remotely. Recent statistics indicate that the smart security segment is projected to account for over 30% of the overall smart home market by 2025. This heightened focus on security is likely driven by rising crime rates and the desire for peace of mind. As a result, the demand for integrated security solutions continues to bolster the smart home market.