Rising Energy Costs

The increasing costs of energy in the US are driving consumers to seek solutions that can help manage their energy consumption more effectively. As energy prices continue to rise, households are looking for ways to reduce their utility bills. The smart home-energy-management-device market is positioned to benefit from this trend, as these devices provide real-time monitoring and control over energy usage. According to recent data, residential energy prices have increased by approximately 15% over the past five years, prompting a shift towards energy-efficient technologies. This market is expected to grow as consumers become more aware of the potential savings associated with smart energy management solutions.

Consumer Awareness and Education

There is a growing awareness among consumers regarding the benefits of energy management solutions, which is positively influencing the smart home-energy-management-device market. Educational campaigns and marketing efforts by manufacturers and energy providers are helping to inform consumers about the advantages of using smart devices to monitor and control energy usage. As more individuals recognize the potential for cost savings and environmental benefits, the demand for these devices is likely to increase. Surveys indicate that approximately 60% of homeowners are now considering smart energy management solutions, reflecting a shift in consumer attitudes towards energy efficiency.

Increased Focus on Sustainability

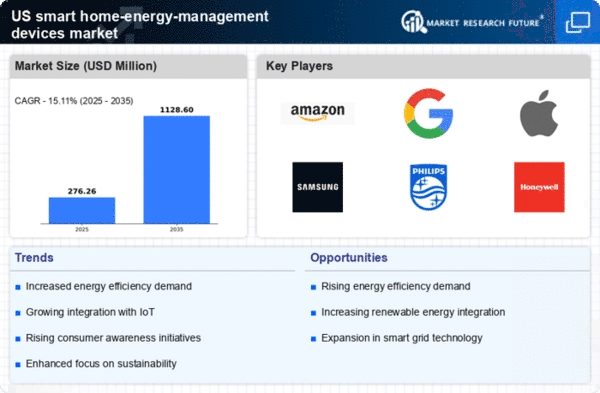

The heightened emphasis on sustainability and environmental responsibility is driving growth in the smart home-energy-management-device market. Consumers are becoming more conscious of their carbon footprints and are actively seeking ways to reduce energy consumption. This trend is supported by a broader societal shift towards sustainable living, with many households prioritizing eco-friendly technologies. The market is expected to benefit from this focus, as smart home-energy-management devices not only help reduce energy costs but also contribute to lower greenhouse gas emissions. Research indicates that homes equipped with these devices can reduce energy consumption by up to 30%, making them an attractive option for environmentally conscious consumers.

Technological Advancements in IoT

The rapid advancements in Internet of Things (IoT) technology are transforming the smart home-energy-management-device market. Enhanced connectivity and interoperability among devices allow for seamless integration and automation of energy management systems. As IoT technology continues to evolve, consumers are increasingly drawn to smart devices that offer convenience and efficiency. The market is projected to expand as more households adopt IoT-enabled solutions, with estimates suggesting a growth rate of around 20% annually over the next five years. This trend indicates a strong potential for innovation and development within the smart home-energy-management-device market.

Government Incentives and Regulations

Government initiatives aimed at promoting energy efficiency and sustainability are significantly impacting the smart home-energy-management-device market. Various federal and state programs offer incentives for homeowners to adopt energy-efficient technologies, including tax credits and rebates. For instance, the Energy Policy Act provides tax deductions for energy-efficient home improvements, which can include smart home devices. These incentives not only encourage adoption but also enhance the market's growth potential. As regulations become stricter regarding energy consumption and emissions, the demand for smart home-energy-management devices is likely to increase, aligning with national goals for energy conservation.