Consumer Awareness and Education

Consumer awareness regarding the benefits of smart appliances is a crucial driver for the smart appliances market. As individuals become more informed about energy savings, convenience, and enhanced lifestyle options, the demand for these products increases. Educational campaigns by manufacturers and retailers are playing a significant role in this process. For example, studies indicate that households using smart appliances can reduce energy consumption by up to 30%, which resonates with environmentally conscious consumers. This growing awareness is likely to foster a more informed customer base, ultimately leading to increased sales and market penetration in the smart appliances market.

Integration with Smart Home Ecosystems

The integration of smart appliances with broader smart home ecosystems is a significant driver for the smart appliances market. As consumers invest in home automation, the demand for appliances that seamlessly connect with other smart devices is increasing. Compatibility with platforms such as Google Home and Amazon Alexa enhances user experience and convenience. Data indicates that nearly 70% of smart appliance users prefer products that can be integrated into their existing smart home systems. This trend suggests that manufacturers focusing on interoperability are likely to capture a larger share of the smart appliances market.

Rising Disposable Income and Urbanization

Rising disposable income levels and urbanization trends are contributing to the growth of the smart appliances market. As more individuals move to urban areas, they seek modern solutions that enhance their living conditions. Increased income allows consumers to invest in advanced appliances that offer convenience and efficiency. Market analysis shows that urban households are more inclined to adopt smart technologies, with a reported increase in smart appliance purchases by 40% in metropolitan regions. This demographic shift is likely to sustain demand for smart appliances, further propelling the market's expansion.

Sustainability and Environmental Concerns

Sustainability is becoming a pivotal concern for consumers, influencing their purchasing decisions in the smart appliances market. As environmental issues gain prominence, consumers are increasingly seeking energy-efficient appliances that minimize their carbon footprint. Smart appliances often come equipped with features that optimize energy usage, such as adaptive learning algorithms that adjust settings based on user habits. Reports suggest that energy-efficient appliances can lead to savings of up to $500 annually on utility bills. This alignment with sustainability goals is likely to attract eco-conscious consumers, thereby driving growth in the smart appliances market.

Technological Advancements in Smart Appliances

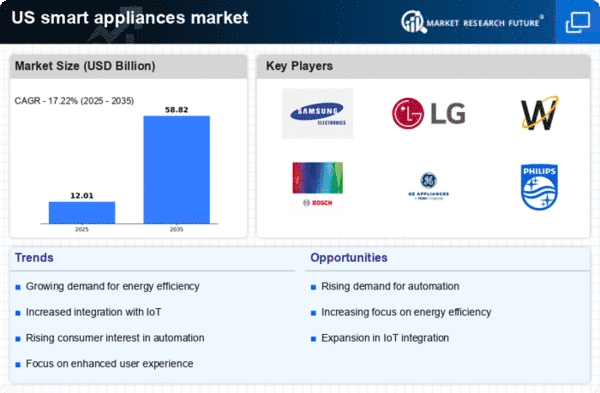

The smart appliances market is experiencing rapid growth due to continuous technological advancements. Innovations in artificial intelligence (AI) and the Internet of Things (IoT) are enhancing the functionality and efficiency of appliances. For instance, smart refrigerators now offer features such as inventory management and recipe suggestions based on available ingredients. The integration of voice-activated assistants is also becoming commonplace, allowing users to control appliances hands-free. According to recent data, the market for smart appliances is projected to reach approximately $100 billion by 2026, indicating a compound annual growth rate (CAGR) of around 25%. This surge in technological capabilities is likely to drive consumer interest and adoption, thereby propelling the smart appliances market forward.