Growth in Recreational Activities

The small gas-engines market benefits from the increasing popularity of recreational activities such as camping, boating, and off-roading. As more individuals seek outdoor experiences, the demand for portable and reliable gas-powered equipment rises. This trend is particularly evident in the sales of generators, chainsaws, and other outdoor tools that enhance recreational activities. Market data indicates that the sales of portable generators alone have seen a growth of approximately 7% annually, reflecting a broader interest in outdoor leisure. The small gas-engines market is thus well-positioned to capitalize on this trend, as manufacturers continue to innovate and expand their product offerings to cater to the needs of outdoor enthusiasts.

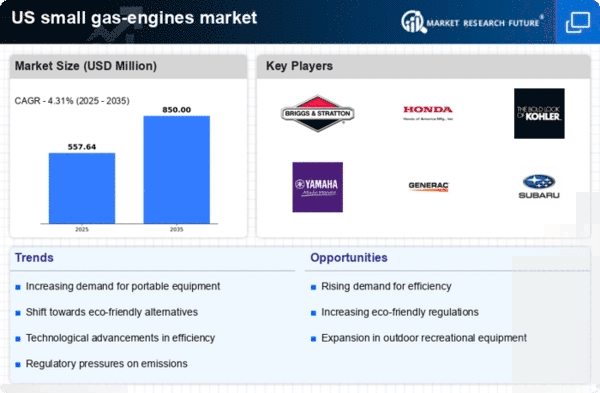

Rising Demand for Outdoor Power Equipment

The small gas-engines market experiences a notable surge in demand for outdoor power equipment, driven by an increasing interest in gardening and landscaping activities among consumers. As more individuals engage in home improvement projects, the need for reliable and efficient gas-powered tools becomes apparent. According to recent data, the outdoor power equipment segment is projected to grow at a CAGR of approximately 5.2% over the next five years. This growth is indicative of a broader trend where consumers prioritize quality and performance in their equipment choices. The small gas-engines market is thus positioned to benefit from this rising demand, as manufacturers innovate to meet consumer expectations for durability and efficiency in their products.

Regulatory Compliance and Emission Standards

The small gas-engines market is significantly influenced by evolving regulatory compliance and emission standards set forth by environmental agencies. In the US, stricter regulations regarding emissions from small engines are prompting manufacturers to develop cleaner and more efficient technologies. The Environmental Protection Agency (EPA) has established guidelines that require reductions in harmful emissions, which has led to innovations in engine design and fuel efficiency. As a result, the small gas-engines market is witnessing a shift towards engines that not only comply with these regulations but also appeal to environmentally conscious consumers. This regulatory landscape is likely to drive investment in research and development, fostering advancements that align with sustainability goals.

Technological Innovations in Engine Efficiency

Technological innovations play a crucial role in shaping the small gas-engines market, particularly in enhancing engine efficiency and performance. Advances in materials science and engineering have led to the development of lighter, more durable components that improve fuel efficiency and reduce emissions. For instance, the introduction of advanced carburetion systems and fuel injection technologies has resulted in engines that deliver higher power output with lower fuel consumption. This trend is likely to attract consumers who are increasingly aware of the cost-effectiveness of fuel-efficient engines. The small gas-engines market is thus experiencing a transformation, as manufacturers invest in cutting-edge technologies to meet the evolving demands of consumers seeking high-performance solutions.

Increased Investment in Infrastructure Development

The small gas-engines market is positively impacted by increased investment in infrastructure development across various sectors, including construction and landscaping. As urbanization continues to rise, the demand for construction equipment powered by small gas engines is expected to grow. This trend is supported by government initiatives aimed at improving infrastructure, which often require reliable and efficient machinery. Market analysts project that the construction sector will see a growth rate of around 4.5% annually, further driving the need for small gas engines. The small gas-engines market stands to gain from this investment, as manufacturers align their product offerings with the needs of a rapidly evolving infrastructure landscape.