Rising Demand for On-Demand Content

The set top-box market is significantly influenced by the rising demand for on-demand content among consumers. As viewing habits shift towards streaming services, the need for devices that can seamlessly integrate these platforms is paramount. In 2025, it is estimated that over 60% of US households subscribe to at least one streaming service, creating a substantial market for set top-boxes that facilitate access to diverse content. This trend indicates a potential growth trajectory for the set top-box market, as manufacturers develop products that cater to the evolving preferences of consumers who prioritize flexibility and convenience in their viewing experiences.

Consumer Preference for Bundled Services

The set top-box market is witnessing a shift in consumer preferences towards bundled services that combine internet, television, and telephony. This trend is particularly pronounced in the US, where consumers are increasingly seeking value in their subscriptions. As of 2025, nearly 40% of households are opting for bundled packages, which often include set top-boxes at reduced prices. This consumer behavior is likely to drive growth in the set top-box market, as service providers leverage these bundles to attract new customers and retain existing ones. Consequently, manufacturers may need to adapt their offerings to align with these bundled service models.

Technological Advancements in Broadcasting

The set top-box market is experiencing a surge due to rapid technological advancements in broadcasting. Innovations such as 4K and 8K resolution support, alongside improved compression technologies, enhance the viewing experience. As of 2025, approximately 30% of households in the US have adopted 4K televisions, driving demand for compatible set top-boxes. Furthermore, the integration of advanced features like voice control and artificial intelligence is becoming commonplace. These enhancements not only attract new consumers but also encourage existing users to upgrade their devices. The set top-box market is thus positioned to benefit from these technological trends, as manufacturers strive to meet consumer expectations for high-quality content delivery.

Increased Competition Among Service Providers

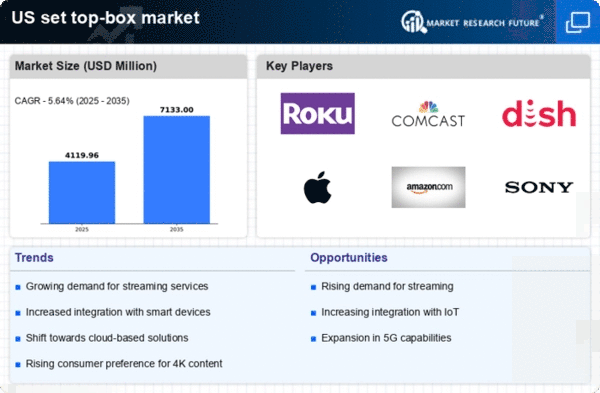

The competitive landscape within the set top-box market is intensifying as service providers seek to differentiate their offerings. Major cable and satellite companies are investing in proprietary set top-box technologies to enhance customer retention. In 2025, the market is projected to grow by approximately 5% annually, driven by these competitive strategies. Providers are increasingly bundling set top-boxes with subscription services, which may lead to higher adoption rates. This competitive dynamic within the set top-box market compels manufacturers to innovate continuously, ensuring that their products remain appealing to both service providers and end-users.

Regulatory Changes and Compliance Requirements

The set top-box market is also affected by regulatory changes and compliance requirements imposed by government entities. In recent years, there has been a push for greater accessibility and interoperability among devices, which has implications for manufacturers. As of 2025, new regulations may require set top-boxes to support a wider range of content formats and accessibility features. This evolving regulatory landscape presents both challenges and opportunities for the set top-box market. Manufacturers that proactively adapt to these changes may gain a competitive edge, while those that fail to comply could face significant market disadvantages.