Regulatory Compliance and Standards

The retail inventory-management-software market is influenced by the need for regulatory compliance and adherence to industry standards. Retailers are required to comply with various regulations related to inventory tracking, reporting, and safety. This compliance necessitates the implementation of robust inventory management systems that can ensure accurate record-keeping and reporting. Recent data indicates that non-compliance can result in penalties of up to $500,000 for retailers, underscoring the importance of effective inventory management solutions. As regulatory pressures increase, the demand for software that facilitates compliance and provides audit trails is expected to grow within the retail inventory-management-software market.

Technological Advancements in Automation

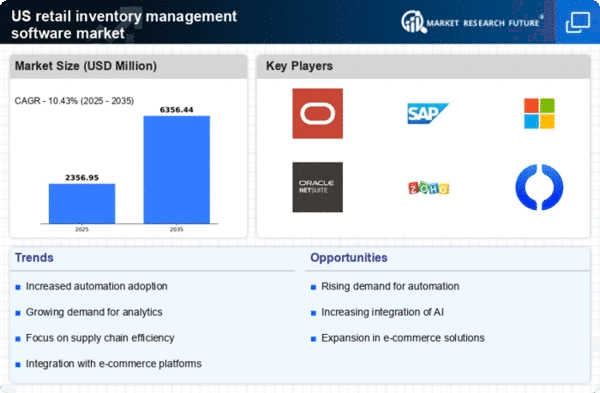

The retail inventory-management-software market is being propelled by technological advancements in automation. Retailers are increasingly adopting automated solutions to streamline inventory processes, reduce human error, and enhance efficiency. Automation technologies, such as robotics and artificial intelligence, are being integrated into inventory management systems to optimize stock replenishment and order fulfillment. It is estimated that automation can reduce inventory holding costs by up to 30%, making it a compelling proposition for retailers. As the demand for efficiency and accuracy grows, the retail inventory-management-software market is likely to see a significant increase in the adoption of automated inventory management solutions.

Increased Focus on Supply Chain Resilience

The retail inventory-management-software market is seeing a heightened focus on supply chain resilience. Retailers are increasingly aware of the vulnerabilities in their supply chains and are seeking software solutions that can enhance visibility and flexibility. A recent survey revealed that 65% of US retailers are investing in technology to improve supply chain management. This trend is likely to drive the demand for inventory management software that offers features such as demand forecasting, supplier collaboration, and risk management. By adopting resilient inventory management practices, retailers can better navigate disruptions and maintain optimal stock levels, thereby strengthening their position in the retail inventory-management-software market.

Rising Demand for Real-Time Data Analytics

The retail inventory-management-software market is experiencing a surge in demand for real-time data analytics capabilities. Retailers increasingly recognize the importance of data-driven decision-making to optimize inventory levels and enhance customer satisfaction. According to recent studies, approximately 70% of retailers in the US are prioritizing real-time analytics to improve operational efficiency. This trend is likely to drive the adoption of advanced inventory management solutions that provide insights into stock levels, sales trends, and customer preferences. As retailers seek to respond swiftly to market changes, the integration of real-time analytics into inventory management software becomes a critical factor in maintaining competitiveness in the retail inventory-management-software market.

Growth of E-commerce and Omnichannel Retailing

The retail inventory-management-software market is significantly influenced by the growth of e-commerce and omnichannel retailing strategies. As online shopping continues to expand, retailers are compelled to adopt sophisticated inventory management solutions that can seamlessly integrate online and offline sales channels. Reports indicate that e-commerce sales in the US are projected to reach $1 trillion by 2025, necessitating robust inventory management systems to handle increased complexity. This shift towards omnichannel approaches requires software that can provide real-time visibility across various platforms, thereby enhancing customer experience and operational efficiency. Consequently, the demand for innovative inventory management solutions is expected to rise within the retail inventory-management-software market.